What Makes A Country Expat-Friendly?

Most people start thinking about moving abroad by asking the wrong kind of question. They ask which country is best for expats, as if there’s some...

9 min read

You’ve spent decades accumulating wealth, only to watch savings whither away as governments and central banks around the world collectively inflate their currencies. As the purchasing power of your savings continues to be eroded by irresponsible fiscal policies, many are looking towards physical gold as a hedge against inflation.

But where to start? For expats looking to diversify their offshore portfolio, it only makes sense to look around the world for the best places to purchase gold. There are several places that offer distinct advantages. It's no secret that countries like UAE and India have long histories of gold trading, but they aren't alone.

No matter where you decide to buy your gold from – be it coins or bars, online or offline - always compare prices and ensure authenticity before finalizing any deal. A little research now will pay off big time later.

Before purchasing gold, whether coins or bars, online or offline, always compare prices and ensure authenticity before finalizing any deal. A little research now will pay off big time later. Being prepared is the only viable option to protect what’s yours, so make sure you also claim your free special report, 19 International Strategies To Protect And Grow Your Wealth Abroad.

Let’s now take a look at the top countries for purchasing gold.

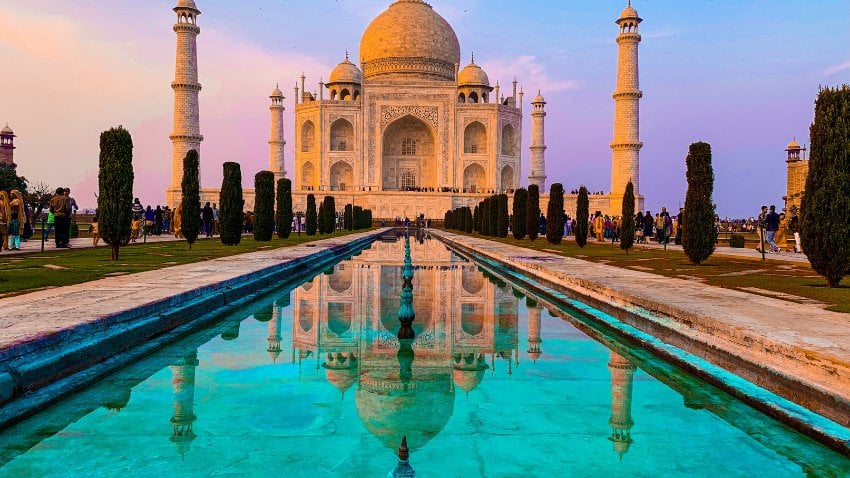

The Taj Mahal in Agra, India

Esteemed as a symbol of abundance and auspiciousness, this precious metal occupies a sacred place within the very essence of Indian heritage.

The act of purchasing gold in India transcends mere financial transactions; it embodies a deeply ingrained reverence for customs and rituals. Whether celebrating weddings, partaking in religious ceremonies, rejoicing during festivals, or exchanging gifts, the presence of gold resonates at the core of every significant event and milestone.

Indeed, to acquire gold in India is to partake in a time-honoured tradition that transcends generations, carrying forth the legacy of prosperity, blessings, and cultural significance that has adorned the Indian subcontinent for centuries.

A trip down any bustling market street will bring you face-to-face with glittering displays from trusted Indian jewellers. Here, buying gold is more than a transaction; it’s partaking in centuries-old traditions where sellers are often family-run businesses passing on their craft generation after generation.

Beyond its role as an adornment or status symbol, owning physical gold offers Indians a sense of financial security. In fact, estimates suggest that around 9-11% of all global physical gold resides within Indian households.

Selling unwanted pieces back to dealers is common, too, when funds are needed. And yes, bargaining over rates might be part-and-parcel here - but remember: always buy your shiny treasure from reputable sources like Expat Money’s trusted partner.

Swiss Village Lungern, Switzerland

In the realm of purchasing physical gold, Switzerland emerges as an enduring beacon of reliability and trustworthiness, solidifying its position as a premier destination for discerning investors. Renowned for its stable banking options and unwavering commitment to financial integrity, Switzerland epitomizes the pinnacle of excellence in the realm of precious metal acquisition.

At the heart of Switzerland's appeal lies its longstanding reputation for trust, security, and confidentiality, attributes that are paramount when navigating the intricate landscape of precious metal transactions. For generations, the Swiss banking sector has cultivated a culture of discretion and reliability, earning the unwavering confidence of individuals and institutions seeking a safe haven for their wealth.

Switzerland's status as a global financial hub provides investors with access to a diverse array of gold products and investment opportunities, ranging from bullion bars and coins to allocated and unallocated accounts. Whether one seeks to acquire physical gold for wealth preservation or portfolio diversification, Switzerland offers a wealth of options tailored to meet the unique needs and preferences of each investor.

The process of buying physical gold from trusted precious metals firms or banks in Switzerland is relatively straightforward. The buyer needs to decide what type of gold they want - whether that be coins or bars - agree on a price, pay upfront, and then the bank will source the gold if not immediately available.

This approach gives buyers peace of mind, knowing their purchase is secure and held by an institution with a strong track record. In fact, many international investors opt for offshore storage in Switzerland due to this high level of confidence.

It's worth noting, though, that while you might have access to your physically held assets at any time during regular business hours, having them stored overseas can make accessing your wealth more difficult should an immediate need arise back home.

Apart from being able to buy physical gold securely within Swiss banks' vaults, these institutions also offer safety features such as insurance policies against theft or damage, which are often included as part of their storage services.

You're essentially getting two things: certified pure investment-grade bullion plus assurance through insured protection against potential risks involved with storing valuable assets like these at home, where risk exposure could potentially be higher without adequate security measures in place.

Grand Cayman, Cayman Islands

The Cayman Islands is an amazing destination for you to purchase gold, too. This Caribbean paradise isn't just about stunning beaches and tax-friendly laws; it's also a safe haven for precious metal investors.

The Cayman Islands is a tax-neutral jurisdiction, meaning it does not levy direct taxes on its residents or businesses. This tax-neutral status has made the country a popular destination for individuals and companies looking to reduce their tax liabilities. The absence of personal income tax, capital gains tax, inheritance tax, and corporation tax makes the country an attractive option for those looking to relocate or establish a business.

The legal framework favours investment here. There are no restrictions or reporting requirements when buying or selling gold, which means transactions remain private.

Buying gold in the Cayman Islands offers numerous advantages for investors seeking to diversify their portfolios and safeguard their wealth. Firstly, the Cayman Islands boast a sophisticated financial infrastructure that provides a secure and transparent environment for gold transactions.

With a reputation for strict adherence to international regulatory standards and a robust legal framework, investors can trust that their gold purchases are conducted with integrity and confidentiality. Additionally, the absence of restrictions or reporting requirements on buying and selling gold in the Cayman Islands ensures that transactions remain private, offering peace of mind to investors concerned about privacy and asset protection.

Furthermore, the Cayman Islands' strategic location as a global financial center positions it as an ideal hub for accessing a wide range of gold products and services. Whether investors are interested in purchasing physical gold bullion coins or exploring investment opportunities in gold-backed securities, the Cayman Islands offer diverse options tailored to individual preferences and investment goals.

Coupled with the jurisdiction's reputation for excellence in banking, investment management, and wealth planning services, buying gold in the Cayman Islands provides investors with a comprehensive and reliable platform for capitalizing on the enduring value and stability of this precious metal.

Related content: How Expats Can Capitalize On The Cayman Island's Political Structure

Dubai Skyline, UAE

The United Arab Emirates (UAE) has emerged as a global leader in the gold market, drawing upon its rich heritage and strategic position to establish itself as a hub for both investors and connoisseurs of this precious metal. With a storied history intertwined with gold, the UAE has cultivated a reputation as one of the preeminent destinations for acquiring investment-grade bullion and exquisite jewelry.

At the heart of this golden landscape lies Dubai, often affectionately referred to as 'the City of Gold.' Here, amidst the glimmering skyline and bustling souks, a plethora of esteemed precious metals firms beckon with their offerings, catering to the diverse needs and tastes of buyers. Whether one seeks meticulously crafted fine jewelry or pristine gold coins and bars to fortify one's investment portfolio, Dubai stands as an unparalleled treasure trove, brimming with endless possibilities.

Indeed, the convergence of these factors renders the UAE a go-to destination for both buyers and sellers seeking to engage in gold transactions. Whether embarking on a quest to bolster their investment portfolio or seeking to partake in the timeless allure of gold through the acquisition of exquisite jewelry, individuals find in the UAE a haven where their aspirations can take flight amidst the shimmering splendour of this precious metal. As the UAE continues to shine brightly on the global stage, its status as a leader in the gold market remains unwavering, beckoning to all who seek to bask in the golden glow of its prosperity and opportunity.

No visit to Dubai would be complete without exploring its famous Gold Souk. This traditional market offers everything from exquisite jewellery designs to certified gold bars. Plus, all items sold meet strict purity standards set by the government – so you know exactly what you’re getting when buying or selling.

If physical purchase isn't appealing, there are more ways in which investors can get their hands on some golden assets in the UAE. Several online dealers provide digital platforms where users can buy and sell gold at real-time prices directly from their homes - no haggling necessary.

Hong Kong city view from peak at Sunrise

Hong Kong stands as a beacon in the global landscape of gold acquisition, renowned for its reputation as a premier destination for purchasing this precious metal. The city's allure stems not only from its strategic location and robust financial infrastructure but also from a combination of factors that make it an ideal hub for gold enthusiasts and investors alike.

One of the compelling reasons why Hong Kong garners acclaim as a top destination for buying gold is its advantageous pricing structure characterized by lower premiums on purchases. This affordability factor, coupled with the absence of value-added tax (VAT) on investment-grade gold, makes acquisitions in Hong Kong notably attractive compared to many other international markets. As a result, investors and collectors can acquire gold at competitive prices, maximizing the value of their investments.

Furthermore, Hong Kong boasts a thriving and well-established gold market underpinned by a network of reputable dealers, refineries, and financial institutions. This robust market presence ensures a diverse array of gold products and investment options, ranging from bullion bars and coins to jewelry and commemorative pieces. Such accessibility and variety empower buyers with the flexibility to tailor their purchases according to their preferences and investment goals.

The answer lies in the trusted precious metals firms operating out of Hong Kong. They offer an edge over other regions with their lower premiums on gold purchases.

Purchasing physical gold from banks like Hang Seng and Bank of China isn't just about savings though. It's also about quality assurance, given these institutions' reputations as reliable sources.

Surely enough, statistics back up this claim - many banks here are known to give customers more bang for their buck when it comes to buying bullion or coins.

Apart from low prices and high-quality products, another factor making Hong Kong stand out is its transparent business environment. The region’s strict rule of law provides protection to consumers against fraudulent dealers – yet another reason behind the thriving local market.

Buying gold jewelry in India is a family tradition

If you're a freedom-loving individual looking to move your wealth overseas, understanding offshore gold storage options is key. Discovering a safe haven to keep your valuable possessions is not merely about purchasing physical gold but also safeguarding it.

With Expat Money’s trusted partner, investing in precious metals offshore is more accessible than ever before, allowing you access to a state-of-the-art depository.

Why should you consider storing your gold overseas? For starters, it helps diversify your investment portfolio geographically and politically. In uncertain times or volatile markets at home, having assets stored securely abroad can offer peace of mind.

Beyond stability considerations, though, are potential tax benefits depending on where you reside and where your IRA is located. The legal landscape varies significantly from country to country, so always seek expert guidance before making decisions related to offshore asset management.

Selecting the right jurisdiction for offshore gold storage needs careful consideration, too, because not all countries provide equal levels of security or favourable legislation around precious metal ownership.

A long history of managing international clients' wealth makes jurisdictions like Switzerland or the Cayman Islands attractive options but emerging players such as the UAE might also be worth considering due to competitive pricing structures and increasing regulatory robustness.

Remember, it's not just about the best countries to buy gold; understanding where to store it securely is equally crucial.

Dipping into digital waters opens up new territories altogether. When you buy physical gold online through reliable platforms that offer competitive prices based on real-time spot price fluctuations – convenience meets value head-on.

Last but not least, let’s not forget about central banks such as those in Switzerland, known for stable banking options that give investors peace-of-mind transactions while also offering choices between owning physical assets or opting for offshore-stored assets.

Purchasing gold is more than just buying a precious metal. It's an insurance policy against economic instability and currency devaluation, especially in today's unpredictable world.

To start your journey into the world of gold, it's crucial to get expert guidance. You need insights from those who have navigated the markets before you. They'll help ensure that you're getting the best value when buying physical or offshore-stored gold.

In today's ever-changing financial landscape, protecting and growing your wealth is paramount. That's where precious metals come in. They offer stability and security, even in times of hyperinflation. Say goodbye to worrying about the devaluation of fiat currencies and hello to the timeless value of gold, silver, and other precious metals. Our trusted partner provides accessible and hassle-free investing options with storage facilities in the Cayman Islands and Hong Kong. Join us in exploring the simplicity and affordability of investing in precious metals. Let's secure your financial future together. Reach out now and discover why this is the best place to buy gold.

Discover the best countries and the best way to buy gold

Embarking on a gold-buying journey isn't just about price but also factors like market stability and cultural significance. The best country to buy gold, we've discovered, depends greatly on your specific needs and preferences.

Hong Kong shines with lower premiums, while the UAE dazzles with high-quality investment-grade bullion. Switzerland offers stable banking options for those keen to hold physical or offshore-stored gold.

The Cayman Islands beckon as a safe haven for buyers looking at secure storage solutions. India's robust market stems from its deep-rooted love affair with this precious metal.

In conclusion, as we navigate the complexities of today's economic climate, safeguarding and expanding your wealth has never been more critical. Precious metals offer a beacon of stability amidst the turbulence, shielding your assets from the erosive effects of hyperinflation. With our esteemed partner, investing in gold, silver, and other precious metals becomes not only accessible but also seamless. Embrace the simplicity and affordability of this investment journey. Take the first step towards securing your financial future today.

If you want the best intel from the expat world, including profitable offshore opportunities, little-known tax-saving strategies, and hard-won insights on immigration, passports, and Plan-B residencies, all delivered to your inbox every single week, then join our daily correspondence, EMS Pulse®. Currently enjoyed by over 84,000 expats and expat-hopefuls worldwide. Fill in the form below to join our newsletter free:

Written by Mikkel Thorup

Mikkel Thorup is the world’s most sought-after expat consultant. He focuses on helping high-net-worth private clients to legally mitigate tax liabilities, obtain a second residency and citizenship, and assemble a portfolio of foreign investments including international real estate, timber plantations, agricultural land and other hard-money tangible assets. Mikkel is the Founder and CEO at Expat Money®, a private consulting firm started in 2017. He hosts the popular weekly podcast, the Expat Money Show, and wrote the definitive #1-Best Selling book Expat Secrets - How To Pay Zero Taxes, Live Overseas And Make Giant Piles Of Money, and his second book: Expats Guide On Moving To Mexico.

Most people start thinking about moving abroad by asking the wrong kind of question. They ask which country is best for expats, as if there’s some...

Across Latin America, people are replacing socialist governments with leaders who promise security, order, economic recovery, and a return to common...

Colombia continues to move up the radar for people looking to live better, spend less, and build international optionality. With improving...