How Safe Is Costa Rica?

Costa Rica has become one of the most popular expat and digital nomad destinations in Latin America, known for its natural beauty, relaxed lifestyle,...

4 min read

Located between Brazil and Argentina, Uruguay is a popular destination for expats looking for beautiful nature and enticing tax conditions. The country boasts a favourable location, with access to the Atlantic Ocean and the Rio de la Plata. Plus, it’s a major food exporter and the largest aquifer in the world, which further increases its appeal for those interested in food and water independence.

Although not many consider Uruguay's potential, this is a phenomenal country for the most demanding expats because it ticks many boxes on the lifestyle and tax fronts. The country’s extensive history of equal treatment to foreign and domestic investors, open immigration policy, and various routes to tax residency, including recent reforms in 2020, further increase its appeal.

In this article, we’re focusing on the generous tax incentive schemes which position the country as an ideal hub for business and investment.

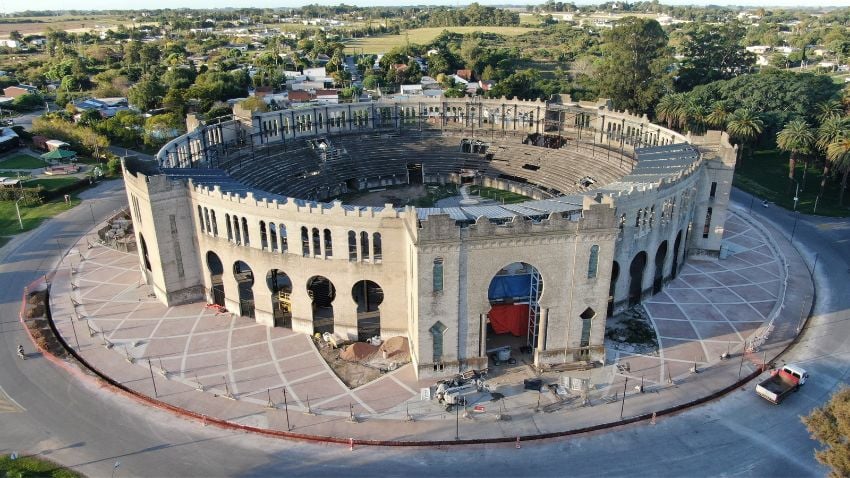

Maldonado, Uruguay

When looking for a new tax residency, expats must find a jurisdiction that meets two crucial criteria: low or preferably no taxes and a strong rule of law. Uruguay does a great job in this regard, positioning itself as a place worth investing or keeping your money in. Multiple banks also offer multi-currency accounts, allowing you to protect yourself against currency fluctuations.

Plus, the current center-right government is business-friendly and welcoming to expats willing to invest in the country. Whether you want to invest in real estate, farmland or even start a tech business, Uruguay is an excellent choice. The country’s tax residency system was further improved in 2020, providing expats with multiple pathways to obtain a tax residency certificate within a timeframe of less than 183 days.

As a business-friendly jurisdiction, Uruguay presents expats with multiple avenues through which to obtain tax residency. No matter your preference or budget, below you’ll find all the available ways to obtain it.

Note that this tax residency is a dynamic condition. Therefore, for each year in which you wish to establish tax residency in Uruguay, you must meet one of the following criteria, which can vary from year to year. First, let’s check the new additional paths to tax residency introduced in 2020.

Expats can secure tax residency by investing in real estate worth $510,00 USD or more, coupled with spending in the country at least 60 days in the country during the calendar year.

Another avenue involves investing at least $2,180,000 USD, directly or indirectly, in any company and creating 15 jobs.

Note that these two alternative routes to residency are still valid. However, If you meet any of the following criteria, you’ll also obtain tax resident status.

Punta Del Este, Uruguay

The person resides in Uruguayan territory based on their vital interests. It is presumed that a person has vital interests based in Uruguay if their spouse and children, who are subject to parental authority, reside in Uruguay.

The person establishes the main nucleus or the base of their activities in Uruguayan territory. This condition is presumed when they generate higher income in Uruguay than in any other country. To determine this, the volume of income earned in Uruguay (which cannot consist solely of pure capital income) is compared with that obtained in any other country (considered individually).

This investment requires an amount exceeding $1,680,000 USD without the need for a minimum stay in Uruguay.

The direct or indirect investment in a company for a value of $5,000,000 USD, provided that the company engages in activities or projects declared of national interest according to the provisions of the Investment Protection and Promotion Law (Law 16,906).

Having looked at all these routes to tax residency, let’s check the advantages of obtaining tax residency in Uruguay.

Montevideo, Uruguay

Paired with a solid rule of law and a high quality of life, obtaining Uruguayan residency comes with multiple benefits. Here are the major advantages that make Uruguay stand out as a tax residency:

Although not a territorial tax system, expats entering into tax residency enjoy a generous tax holiday period during the first 11 years. Foreign income remains tax-free for the initial eleven years of their tax resident status (the year in which the status is obtained plus an additional ten). This is a great opportunity to keep more of your money in your pockets and use it however you like. Alternatively, you can opt for a flat 7% rate from the moment you become a tax resident.

Beyond the tax holiday period, Uruguay imposes taxation on only two types of foreign income: interest and dividends. The tax rate for these income categories is set at a competitive 12%. To prevent double taxation, Uruguay automatically credits any taxes paid overseas on these dividends and interest. Importantly, other types of foreign income, such as lease income or capital gains, remain entirely exempt from taxation in Uruguay.

Expats have the flexibility to choose their taxation approach after the eleventh year. They can either continue enjoying the tax holiday period or opt for an alternative arrangement. The alternative allows individuals to waive the tax holiday and, instead, pay a 7% rate over dividends and interest. This flexibility caters to varying financial strategies and preferences.

Uruguay does not levy any asset or property tax on foreign assets. This exemption provides additional financial relief for expatriates and contributes to the country's appeal as a tax-friendly destination.

Tax residents currently enjoying the initial five years of exemptions can extend their tax benefits. By investing $510,000 USD or more from January 22nd, 2021 and spending at least 60 days in the country during the calendar year, you can secure a five-year additional extension.

Together, these advantages position Uruguay as a financially beneficial tax residency destination that prioritizes the stability and comfort of its residents. Expats can benefit from this favourable tax climate and environment for professional and personal growth.

Colonia del Sacramento, Uruguay

Alongside its strategic geographical position, stunning landscapes and food and water independence, Uruguay boasts an enticing tax regime filled with advantages for expats. The country’s extensive history of equal treatment for both local and foreign investors, paired with an open immigration policy, welcomes expats who want to invest and even live in the country.

Recent reforms in 2020 have further improved Uruguay’s tax residency scheme, providing expats with multiple routes to secure residency within 183 days. Whether you want to invest in real estate, companies of national interest or turn Uruguay into your new home, you count on great flexibility to optimize your tax bill and seize the advantages of this underrated nation.

In November this year, my clients and I went on an investment tour in Uruguay, and all of them were happily surprised by how much potential this tiny country has. I recorded a podcast episode about this trip and also a video showcasing all the activities we did. Make sure to check them out!

If you want the best intel from the expat world, including profitable offshore opportunities, little-known tax-saving strategies, and hard-won insights on immigration, passports, and Plan-B residencies, all delivered to your inbox every single week, then join our daily correspondence, EMS Pulse®. Currently enjoyed by over 84,000 expats and expat-hopefuls worldwide. Fill in the form below to join our newsletter free:

Written by Mikkel Thorup

Mikkel Thorup is the world’s most sought-after expat consultant. He focuses on helping high-net-worth private clients to legally mitigate tax liabilities, obtain a second residency and citizenship, and assemble a portfolio of foreign investments including international real estate, timber plantations, agricultural land and other hard-money tangible assets. Mikkel is the Founder and CEO at Expat Money®, a private consulting firm started in 2017. He hosts the popular weekly podcast, the Expat Money Show, and wrote the definitive #1-Best Selling book Expat Secrets - How To Pay Zero Taxes, Live Overseas And Make Giant Piles Of Money, and his second book: Expats Guide On Moving To Mexico.

Costa Rica has become one of the most popular expat and digital nomad destinations in Latin America, known for its natural beauty, relaxed lifestyle,...

Mexico remains one of Latin America’s most compelling destinations, especially for North Americans. More than a million expats call it home, and tens...

South Korea is far more than K-pop and K-dramas. It is a country known for outstanding food, from bustling street markets to high-end dining, as well...