Living In Singapore: Pros & Cons You Should Know

Singapore is often described as a city that works, and it totally deserves its reputation. This small island nation in Southeast Asia has built one...

4 min read

If one thing in life is certain, it is paying taxes. Everything from shopping at the grocery store to buying or selling a house and your salary may involve a mandatory contribution to the tax authorities. In many developed countries, the latter can be up to 40%. Fortunately, all nations are not created equal, and some allow you to reduce your tax liabilities significantly or reduce them to zero.

Now, you are probably wondering how a government can provide basic services like infrastructure, education, and public safety services without taxes. The short answer is through other revenue streams. For example, natural resource extraction alone is enough to fund the expenditures of many Gulf States. As such, their citizens often pay little, if any, income taxes.

Island nations like Saint Kitts & Nevis and the Cayman Islands make do with tourism and the financial sector earnings.

However, living in a country with a territorial tax system can also have benefits. Namely, foreign-sourced income is not taxed. As such, the list below is a mix of stable and low-tax jurisdictions with a decent quality of life offering residency through investment.

Punta Del Este, Uruguay

Sandwiched between Argentina and Brazil, Uruguay is one of the smallest countries in South America. However, don’t let the small size fool you, as it is one of the most stable and developed countries in the Americas. Offering a high standard of living and world-class healthcare, Uruguay has made a name for itself in terms of tax reduction strategies. Obtaining residency means no taxes on foreign-sourced income for 11 years, with options to reduce that even further by investing in certain industries.

Related content: Why Uruguay Residency Is So Appealing

San Juan Del Sur, Nicaragua

Nicaragua may not offer all of the amenities of Costa Rica or Panama, but it makes up for it in terms of affordability, quality of life, and safety. Unsurprisingly, Nicaragua has consistently been ranked as one of the best countries for retirees in the last few years.

Nicaragua is not a tax haven, but the country offers residents several means for reducing tax liabilities. There are no taxes on foreign-sourced income and additional tax breaks for investing in the tourism and hospitality industries.

Related content: Nicaragua's Political Situation And How It Affects Expats

Guayaquil, Ecuador

Ecuador is another country that has been gaining popularity in expat circles in recent years and is often compared to Costa Rica. It is one of the more affordable options on our list, with a couple able to live comfortably on $2,000 USD a month.

While Ecuador may not receive a top mark for safety, it has a few things going for it. For starters, foreign-sourced income is not taxed. In addition, it is one of the easiest countries when it comes to obtaining residency. Investing $45,000 USD in real estate or CDs that pay 8-10% annual interest opens the door to temporary residency, with the ability to obtain citizenship after five years.

Related content: 6 Reasons You Should Move To Ecuador

Jaco, Costa Rica

Known for its beautiful beaches, Costa Rica has long been regarded as a tropical paradise. In addition, it is one of the safest and most stable countries in Latin America, with affordable health care and high living standards. Unsurprisingly, it is one of the most popular destinations for nature lovers, expats, and retirees alike.

Costa Rica is certainly not a tax haven by any means, and it is more expensive than other countries in the region. However, living there can have benefits, such as no taxes on foreign-sourced income and several options for obtaining residency.

Related content: Getting Residency In Costa Rica Is Pretty Easy

Panama City

Like its northern neighbour, Costa Rica, Panama is a popular expat destination. In addition, it is one of the most important financial hubs in the Americas, with the country having a high standard of living.

Often referred to as the “Switzerland of the Americas,” Panama offers several asset protection strategies and is known for its banking secrecy laws and ease of forming a company. Panama also offers several investment and pensioner visa options, with the added benefit of foreign-sourced income being tax-exempt.

Related content: Panama Pacifico And the Colon Free Trade Zone

Dubai Business Bay

The United Arab Emirates is certainly not cheap, but it makes up for it in terms of safety, excellent living standards, and world-class infrastructure. In addition, it has one of the freest economies in the world and is regarded as being one of the most open and tolerant Muslim countries.

Thanks to a vibrant petroleum and financial sector, residents of the UAE do not pay income taxes. In addition, residency can be obtained by purchasing $204,000 USD or more in real estate.

Related content: Residency In The UAE: How To Easily Move To The United Arab Emirates

Bahrain enjoys a wealthy economy

Bahrain is probably not the first country you would think of when discussing low taxes. However, this small Gulf State manages its earnings from the oil sector just fine. As such, Bahrain has been able to build world-class infrastructure and provide a high standard of living without levying income taxes on its citizens. In other words, no income or wealth tax and no taxes on capital gains.

In addition, Bahrain is regarded as one of the more open Muslim countries in the region and hosts a sizable expat population. Obtaining residency is fairly easy, and the country offers several golden visa options. It is worth a look for anyone interested in living in the region.

Related content: The Top 5 Currencies Least Affected By Inflation

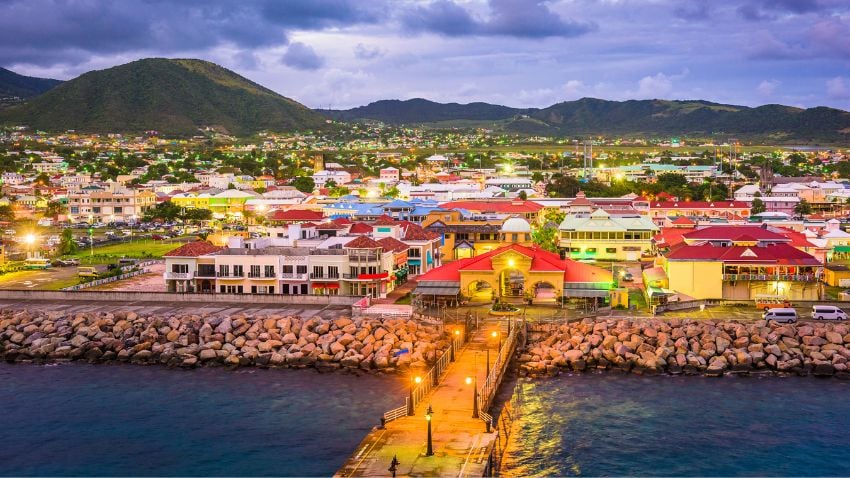

Basseterre, St. Kitts And Nevis

Despite being one of the smallest nations in the world, these tiny Caribbean islands have a lot to offer. Aside from a picturesque landscape with beautiful beaches covered in black volcanic sand, Saint Kitts and Nevis are the perfect Plan B for tax mitigation strategies.

Why Saint Kitts and Nevis? There are some notable tax benefits, such as no income, wealth, or inheritance taxes. That may be enough for some, but it is worth mentioning they have one of the most affordable citizenship-by-investment programs in the world. This can be achieved by donating $150,000 USD to the Sustainable Growth Fund or investing $400,000 USD in a government-approved real estate project. Not only that, Saint Kitts and Nevis has one of the strongest passports in the Caribbean, with visa-free access to 157 countries, including the UK, Hong Kong, and the Schengen zone.

Related content: St. Kitts And Nevis' Citizenship Program Undergoes Monumental Overhaul

Grand Cayman, Cayman Islands

When thinking about a tropical island paradise, chances are the Cayman Islands come to mind. Aside from their beautiful beaches, this is one of the lowest tax jurisdictions in the world, and residents do not pay income, property, or capital gains taxes. Not only that, the Cayman Islands offer an excellent quality of life, good health care, and several residence-by-investment options.

The only downsides to the Caymans are the high cost of living and a minimum investment of $600,000 USD for a golden visa.

Related content: The Many Residency By Investment Options In The Cayman Islands

There are many options for countries to live in, such as paying low taxes. Many of these countries have residency programs, retirement programs and even digital nomad visa programs. Among these options, surely one will fit what you are looking for. It is important to note that tax rates and regulations can vary depending on individual circumstances, and the Expat Money Team is here to help you with these questions.

If you want the best intel from the expat world, including profitable offshore opportunities, little-known tax-saving strategies, and hard-won insights on immigration, passports, and Plan-B residencies, all delivered to your inbox every single week, then join our daily correspondence, EMS Pulse®. Currently enjoyed by over 84,000 expats and expat-hopefuls worldwide. Fill in the form below to join our newsletter free:

Written by Mikkel Thorup

Mikkel Thorup is the world’s most sought-after expat consultant. He focuses on helping high-net-worth private clients to legally mitigate tax liabilities, obtain a second residency and citizenship, and assemble a portfolio of foreign investments including international real estate, timber plantations, agricultural land and other hard-money tangible assets. Mikkel is the Founder and CEO at Expat Money®, a private consulting firm started in 2017. He hosts the popular weekly podcast, the Expat Money Show, and wrote the definitive #1-Best Selling book Expat Secrets - How To Pay Zero Taxes, Live Overseas And Make Giant Piles Of Money, and his second book: Expats Guide On Moving To Mexico.

Singapore is often described as a city that works, and it totally deserves its reputation. This small island nation in Southeast Asia has built one...

Panama’s geographic size is modest, but its global relevance is not. The country connects two oceans and two continents, operates on a dollarized...

Honduras’ newly elected president, Nasry Asfura of the conservative National Party, was sworn in on January 27, 2026. The election, held on November...