The Real Cost Of Living In Colombia

Colombia inspires many thoughts and feelings. Some think of global pop icons like Shakira, J. Balvin, and Karol G. Others are drawn to the magical...

7 min read

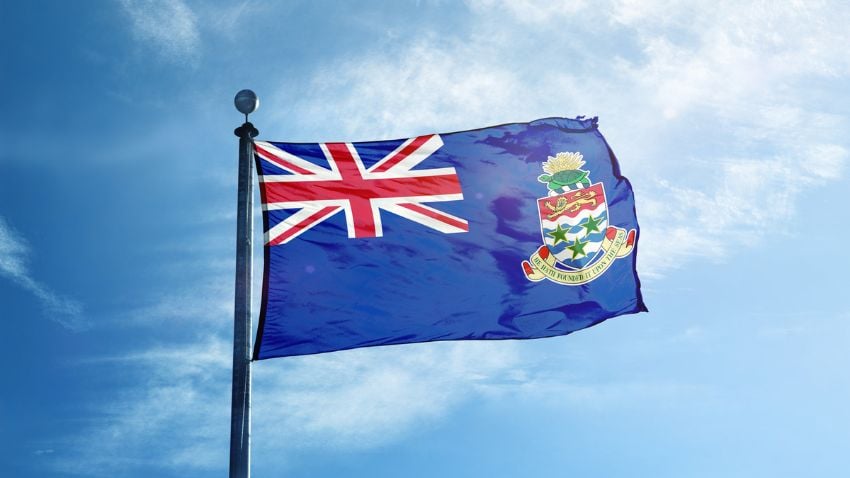

In a country with a small population of around 70,000, most are foreigners with temporary work visas, residency visas, or permanent visas. The Cayman Islands is desirable for expats due to its tax haven status, high standard of living comparable to Switzerland, and typical Caribbean weather conditions.

You can find the Cayman Islands west of Haiti and the Dominican Republic, east of Belize and Mexico's southernmost tip, and its capital is George Town. It is home to many islands, beaches, and coral reefs to be explored. It is a unique and luxurious place to live long-term.

The Cayman Islands offer a plethora of residency by investment options that cater to the diverse needs and preferences of individuals and families. From the crystal-clear waters to the vibrant communities, the Cayman Islands provide a unique blend of natural beauty and modern living, making it an appealing destination for those seeking a new place to call home.

One of the standout aspects of residency by investment in the Cayman Islands is the opportunity to access world-class education for individuals and their families. The islands boast excellent schools and educational institutions, ensuring that residents receive a top-notch education.

Aerial view of the coastline of Grand Cayman, Cayman Islands

There are five unique ways to acquire permanent residency in the Cayman Islands: two through real estate investment and three via business investment. Real estate is the more popular of the two choices for residency by investment.

The criteria for residency by investment in the Cayman Islands vary depending on the specific category one chooses. Whether it's an investment in real estate, a business venture, or a financial contribution to the islands, there are diverse pathways to meet the requirements. Detailed information about each category is readily available to interested applicants.

Residents of the Cayman Islands benefit from a diverse and welcoming community. The islands have a rich cultural tapestry, with people from all over the world calling it home. This inclusivity creates a vibrant atmosphere that welcomes newcomers with open arms.

The application process is handled by a dedicated team of professionals who are well-versed in the intricacies of the Cayman Islands' immigration laws. This ensures a smooth and efficient process for applicants and their families.

The Cayman Islands government offers two residency by investment programs through real estate initiatives. A Residency Certificate for Persons of Independent Means is the first choice and a Certificate of Permanent Residence for Persons of Independent Means, which offers the applicant a lifelong grant, is the second choice.

This residency is a 25-year visa, with no ability to apply as a British overseas territory citizen. At the end of the visa’s validity, you can renew it.

With this residency visa, you will not be allowed the right to work in the Cayman Islands;

Upon the approval of your application, you will be granted your residency visa, renewable in 25 years. However, you must make an annual declaration to the Department of Immigration. This declaration is to ensure the requirements are still met and that you were in the Cayman Islands for a minimum of thirty days in aggregate during the last calendar year;

To apply for a Residency Certificate (Persons of Independent Means) visa, you must provide evidence of a regular source of income of $150,000 USD or more annually, maintain a bank account with no less than $490,000 USD in assets at all times, have invested $1,220,000 USD in the Cayman Islands, of which at least $675,000 USD must be in real estate;

This Residency Certificate visa has a $610 USD application fee, and once you have been approved, there is an issue fee of $24,500 USD plus $1,220 USD per dependant. You will have an annual charge for dependents of the same value as issue fees.

This residency is an indefinite residency visa that allows you to apply for British Overseas Territory citizenship. A successful applicant of this initiative will be granted indefinite residency in the Cayman Islands.

With this visa you won’t be allowed to work, but you can submit an extra application for the right to work;

This visa is the only method to obtain a British Overseas Territories citizenship and naturalization with a residency by investment visa;

Upon the approval of your application, you will be granted your permanent residency visa; however, you will have to make an annual declaration to the Department of Immigration;

To apply for a Certificate of Residency for a Person of Independent Means, you must prove that you have an investment of at least $2,500,000 USD in developed real estate in the Cayman Islands; and that you have the financial means to maintain yourself and any dependents;

A Certificate of Permanent Residence costs $610 USD in application fee and, upon approval, a $122,000 USD plus $1,220 USD per dependant in issue fees.

The citizenship by investment (CBI) programs given in other Caribbean nations is not the same as the residency by investment through real estate programs offered in the Cayman Islands regarding the real estate possibilities available.

Map of Caribbean Sea

International investors can choose from three programs: establishing an offshore company, investing directly in the Cayman Islands, or developing a prominent corporate presence.

As long as you are engaged in an offshore-only activity, you are eligible to open your own licensed business and get a work visa for yourself and any relatives. For instance, you can work from the Cayman Islands to assist your company's administrative needs. After working in the Cayman Islands on a permit for eight years, you can apply for an annual work permit and become a permanent resident.

You can choose this option and become qualified to apply for a 25-year residence grant by making a minimum investment of $1,150,000 USD in a locally licensed employment-generating enterprise. Both new and existing businesses are possible.

You can qualify for a 25-year residency grant if you have 10% or more of the shares in a corporation or if you are the senior management of an exempted offshore firm, which often provides financial services, reinsurance, captive insurance, or family offices.

Related content: What Is An International Business Corporation (IBC)?

Cayman Islands currency, the Cayman Islands dollar

The Cayman Islands are thriving as a financial hub since there is no direct taxation. As of 2017, there were more than 65,000 registered businesses, including more than 280 banks, 700 insurers, and 10,000 mutual funds. In 1997, a stock exchange was inaugurated.

Another important industry is tourism, which contributes roughly 70% of the GDP and 75% of the revenue from exports. The tourism sector mostly welcomes guests from North America and targets the luxury market. More than 2.1 million tourists visited the country overall in 2016, with the US accounting for more than 75 percent of those visitors.

The Cayman Islands do not impose company taxes, payroll, property, capital gains, or taxes on capital gains or distributions. With all of these tax benefits, the Cayman Islands have become a tax haven for affluent people and a preferred base of operations for hedge funds. It is also a desired place for multinational corporations to set up shell companies as subsidiary entities to lessen the losses due to taxes on corporate income.

Offshore corporations pay licensing fees to the Cayman Islands government in place of taxes, based on the maximum amount of share capital a company can raise (its authorized share capital). This arrangement is frequently significantly less expensive than paying the corporate tax rate in the US or many other countries.

Hawksbill turtle swimming in the blue Caribbean sea in Grand Cayman

Any real estate is eligible as long as it is already developed and can be occupied immediately; applicants are not restricted to buying homes in government-approved projects.

Aside from the number of properties a foreign citizen may own without having a business license, there are no limits on foreign ownership of real estate, which is another advantage. Additionally, no permits are needed for alien landholding. Thanks to effective civil service and service providers in the legal, banking, and real estate industries, the Cayman Islands' ease of transmitting property is often a seamless procedure.

The security of buying real estate overseas is a common worry for international buyers. However, the Cayman Islands can provide further assurance because it uses the Torrens land registration system. The register keeps track of all property ownership facts and title documents in the Cayman Islands. It also includes a registration map that shows the borders of each privately held plot of land. A legislative title guarantee requires the Cayman Islands government to compensate anyone who loses money due to a mistake in the land register that the government can’t fix. Because of this, getting title insurance is typically viewed as unnecessary.

Caribbean beach at Cayman Island

The Cayman Islands are desirable due to their high standard of living. The Cayman Islands are not only stunning and have a pleasant climate all year round, but they also have two international airports, making it easy to travel to and from the islands. The Cayman Islands have first-rate private hospitals, world-class restaurants, and excellent local services. Beyond this, its infrastructure and banking and financial services sectors are among the best in the world.

Naturally, there is a cost associated with all of this, which is not insignificant. Both living there and applying for residence there are relatively expensive in the Cayman Islands. Although it is pretty costly, becoming a resident of the Cayman Islands is a fairly simple process.

One of the most enticing aspects of the Cayman Islands is the stunning natural beauty that surrounds residents. Miles of sandy beaches, warm sun, and inviting waves offer a perpetual vacation-like atmosphere. The islands are renowned for their world-class diving and snorkeling sites, where residents can explore vibrant coral reefs and swim with exotic fish.

Little Cayman, Cayman Islands

The Cayman Islands is a great place to get your permanent residency if you have the financial means. You will enjoy a home in one of many paradise islands, and you won’t pay as much in taxes as you would in other countries. An amazing aspect of the investor visa is that you can bring your family, and their fees are relatively cheap. I couldn’t forget to mention that the Cayman Islands have excellent medical care. Overall, I would say living in a paradise island nation with my family, and excellent healthcare is a very compelling idea. Families seeking ways to safeguard their health and money and establish residence in countries that offer these conditions should consider the Cayman Islands.

For those who appreciate the finer things in life, the Cayman Islands offer a range of luxury resorts and vacation opportunities. The islands are synonymous with relaxation, offering residents a chance to unwind and rejuvenate in style.

While there are numerous advantages to residency by investment in the Cayman Islands, it's essential to be aware of certain restrictions and regulations that apply. However, the overall experience of living in this tropical paradise with access to excellent education, a welcoming community, and unparalleled natural beauty makes the Cayman Islands an attractive choice for individuals and families seeking a new place to call home.

If you want the best intel from the expat world, including profitable offshore opportunities, little-known tax-saving strategies, and hard-won insights on immigration, passports, and Plan-B residencies, all delivered to your inbox every single week, then join our daily correspondence, EMS Pulse®. Currently enjoyed by over 84,000 expats and expat-hopefuls worldwide. Fill in the form below to join our newsletter free:

Written by Mikkel Thorup

Mikkel Thorup is the world’s most sought-after expat consultant. He focuses on helping high-net-worth private clients to legally mitigate tax liabilities, obtain a second residency and citizenship, and assemble a portfolio of foreign investments including international real estate, timber plantations, agricultural land and other hard-money tangible assets. Mikkel is the Founder and CEO at Expat Money®, a private consulting firm started in 2017. He hosts the popular weekly podcast, the Expat Money Show, and wrote the definitive #1-Best Selling book Expat Secrets - How To Pay Zero Taxes, Live Overseas And Make Giant Piles Of Money, and his second book: Expats Guide On Moving To Mexico.

Colombia inspires many thoughts and feelings. Some think of global pop icons like Shakira, J. Balvin, and Karol G. Others are drawn to the magical...

Most people start thinking about moving abroad by asking the wrong kind of question. They ask which country is best for expats, as if there’s some...

Across Latin America, people are replacing socialist governments with leaders who promise security, order, economic recovery, and a return to common...