Top Things To Do In Panama In 2026

Panama’s geographic size is modest, but its global relevance is not. The country connects two oceans and two continents, operates on a dollarized...

4 min read

We have covered several trusts and foundations in previous articles. They are similar in some regards but belong to different law types. A Trust is a Common Law instrument, so it is used in Anglo-Saxon countries, whereas a foundation is a Civil Law. If employed properly and depending on the specific case, these financial tools will help you save thousands (if not millions), protect your wealth, pass on your assets to the next generation, and invest and acquire property.

A country, state, or region might follow any of the Law categories mentioned above, so it is crucial to know the pros and cons of each jurisdiction. In general, foundations are popular in Europe and countries colonized by Belgium, France, Portugal, The Netherlands, or Germany. Some countries offering foundations are Luxembourg, Switzerland, Liechtenstein, and Panama. In contrast, you might see former British colonies or overseas territories offering Trusts. For example, Cyprus, the Cook Islands, and Monaco (despite not being conquered by Britain) offer interesting Trusts.

Before establishing any of these, you must be precise in defining your personal goals to make an informed decision and secure your new life abroad.

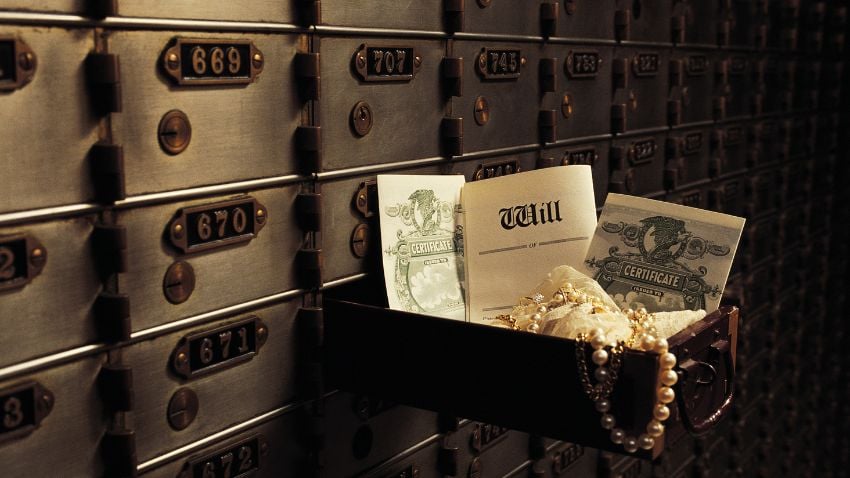

A trust or foundation can be a great tool to guarantee your family with assets and wealth.

Before diving into the primary differences between the two categories, let us briefly define each.

On the one hand, a Trust is a Common Law financial and legal tool that allows a settlor to delegate the management of his or her assets to a third party, called a trustee, who will manage them according to the settlor’s instructions. These often include benefiting certain people or organizations called beneficiaries. Apart from tax benefits, Trusts are a phenomenal instrument for protecting your wealth and your privacy.

On the other hand, a Foundation is a Civil Law financial and legal tool, that allows a founder to dedicate his or her property for a specific purpose, often related to charity. However, they come with various tax benefits, and in some cases, it’s possible to perform financial transactions. The founder transfers property to the Foundation, which has a board in charge of the property's management and works towards the purpose the Foundation pursues, i.e. benefitting family members, non-profit organizations, science, education, etc.

As you can see, both are excellent vehicles to execute financial plans, such as securing personal assets and protecting your estate. One is not better than the other, so depending on your concrete goals, will decide if you should use one over the other. Now that you get the big picture, let us discuss the main differences between the two.

Related article: The Basics Of How To Get A Second Passport Or A Second Residency.

A trust can be as simple as a verbal agreement between the trustor and the trustee.

A trust comes into existence when the grantor gives a trustee the ownership and management of a set of assets. Trusts are usually devoted to estate planning and cutting off an inheritance or estate taxes. There are multiple Trust categories such as Testamentary, Special Needs, Spendthrift, Life Insurance, Generation-skipping, Bypass, Marital and Charitable. Trusts may be revocable or irrevocable.

On the other hand, foundations are mainly non-profit organizations. A legal person (individual or corporation) gives away a set of assets to create a Foundation. At that very moment, the founder loses all ownership over them. This first donation represents the creation of a new foundation.

As opposed to a Foundation, a trust is not a legally incorporated entity. A foundation is a legal entity, so in practice, it is like a company, whereas a Trust is a legal relationship between settlors, trustees, and beneficiaries. Despite these three actors, only the settlor and the trustee are the two parties signing an agreement, and a Trust does not need to be registered.

A Foundation often pursues charitable purposes, whereas Trusts are dedicated to wealth protection, tax optimization, and legal protection from creditors and lawsuits. Both a Foundation and a Trust allow an individual or company to hide their identity and in some way abandon their assets, which are managed then by a management board in the case of the former or a board of trustees in the case of the latter. These boards must comply with the guidelines laid out on the Foundation Charter and the Trust Deed, respectively. A founder or grantor technically loses the ownership of their property but still controls how it is used and distributed on the proper documents.

A foundation is a legal entity like a corporation, and all assets under it can bring financial security to you and your loved ones.

Hospitals, companies, and churches often create a foundation to support a charitable cause such as childhood disease, hunger, education, research, general healthcare, etc. A foundation may have a large staff, but it has no shareholders. As a result, there are no owners. In contrast, the owners of a Trust are the beneficiaries, so they can protect their rights and the piece of property they are entitled to according to the Trust Deed.

A certificate of Trust may or may not be public, but not the Trust itself. However, a Foundation’s documents are publicly filed as if it was a corporation. Beyond estate planning, a Trust protects assets, real estate, and property (cars, yachts, antiques, etc.). There are also charitable trusts. A foundation and a Trust may be created by an individual, family, or corporation.

In terms of duration, both can have a limited or unlimited lifetime depending on the particular features of the Trust or the Foundation. Settlors and founders often enjoy much flexibility and can even determine under what circumstances the vehicle must terminate. On top of that, in some cases, there exists the possibility to dismiss or appoint beneficiaries or board members according to the Trust Deed or Foundation Charter.

Before moving on to the conclusion and letting you know which I prefer, here is a list of some jurisdictions offering trusts that you can read about:

And here is also a list of jurisdictions offering Foundations you can read about:

A Panama foundation is one of the best foundations to acquire. It offers many benefits and privileges.

I am afraid to say that it depends on you and your primary goals. As you can see, both have their pros and cons. If you use them correctly, you can protect and multiply your wealth and privacy, get tax exemptions, support charitable causes, avoid lawsuits and escape greedy creditors. Personally, I prefer the Panama Private Interest Foundation, which I covered extensively in a previous article. Your situation is unique, so it must be studied carefully to know the best options for you. If you are still undecided, contact us, and we will find the right Trust or Foundation so that you can secure your wealth abroad.

If you want the best intel from the expat world, including profitable offshore opportunities, little-known tax-saving strategies, and hard-won insights on immigration, passports, and Plan-B residencies, all delivered to your inbox every single week, then join our daily correspondence, EMS Pulse®. Currently enjoyed by over 84,000 expats and expat-hopefuls worldwide. Fill in the form below to join our newsletter free:

Written by Mikkel Thorup

Mikkel Thorup is the world’s most sought-after expat consultant. He focuses on helping high-net-worth private clients to legally mitigate tax liabilities, obtain a second residency and citizenship, and assemble a portfolio of foreign investments including international real estate, timber plantations, agricultural land and other hard-money tangible assets. Mikkel is the Founder and CEO at Expat Money®, a private consulting firm started in 2017. He hosts the popular weekly podcast, the Expat Money Show, and wrote the definitive #1-Best Selling book Expat Secrets - How To Pay Zero Taxes, Live Overseas And Make Giant Piles Of Money, and his second book: Expats Guide On Moving To Mexico.

Panama’s geographic size is modest, but its global relevance is not. The country connects two oceans and two continents, operates on a dollarized...

Honduras’ newly elected president, Nasry Asfura of the conservative National Party, was sworn in on January 27, 2026. The election, held on November...

For a growing number of Americans, cost-of-living math no longer works. Housing feels harder to reach, everyday costs keep climbing, and long-term...