Top Things To Do In Panama In 2026

Panama’s geographic size is modest, but its global relevance is not. The country connects two oceans and two continents, operates on a dollarized...

7 min read

Bank secrecy, also known as banking confidentiality or financial privacy, is a legal principle that requires banks and other financial institutions to protect their clients' personal and financial information. Under bank secrecy laws, banks are generally prohibited from disclosing any information about their customers' accounts, transactions, or other related activities to third parties without the customer's consent, except when required by law enforcement or court orders.

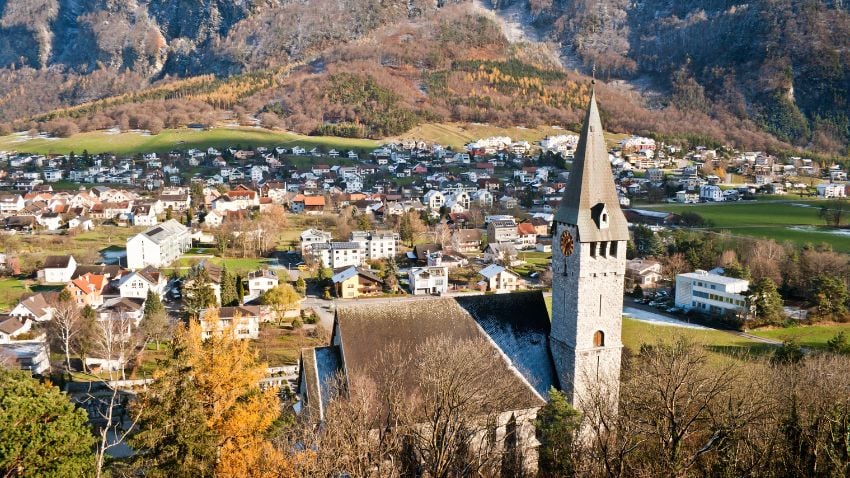

The most famous example of bank secrecy is the Swiss banking system, which dates back to the 18th century

Bank secrecy has its roots in the early European banking systems, with the most famous example being the Swiss banking system, which dates back to the 18th century. The primary goal of bank secrecy was to protect clients' privacy and safeguard their financial assets from potential threats, such as political instability, persecution, or confiscation. In addition, bank secrecy has historically been an important selling point for banks in attracting wealthy clients and foreign capital, as it provided a safe haven for their assets.

Privacy protects customer identities, account balances, transaction histories and other sensitive confidential data

In today's globalized economy, bank secrecy has evolved significantly due to increased financial transparency requirements and the growing importance of combating economic crimes such as tax evasion, money laundering, and terrorist financing. Understanding the history, evolution, and current status of bank secrecy is essential for individuals, businesses, and governments to navigate the complex world of international finance. It helps to balance maintaining individual privacy rights and ensuring global financial transparency, while addressing the ethical and legal concerns surrounding bank secrecy.

Related content: The Basics Of How To Get A Second Passport Or A Second Residency

One of the core tenets of bank secrecy is the protection of customers’ privacy. Banks are obligated to maintain strict confidentiality of their customers' personal and financial information, ensuring that their clients can conduct financial transactions and manage their assets discreetly. This privacy protects client identities, account balances, transaction histories, and other sensitive data from unauthorized disclosure.

Bank secrecy also involves safeguarding sensitive financial information from unauthorized access or potential misuse. This protection is crucial in preventing financial crimes such as identity theft, fraud, and unauthorized account access. Banks employ various security measures and protocols to ensure that their clients' financial information remains confidential and secure.

Financial privacy includes bank secrecy, data protection, theft prevention measures and individual privacy rights

While bank secrecy and financial privacy may seem interchangeable, they have distinct meanings. Bank secrecy refers to a legal framework that prohibits banks from disclosing customer information to third parties, except under specific circumstances such as court orders or law enforcement requests. On the other hand, financial privacy is a broader concept encompassing various aspects of an individual's or entity's right to control the access, use, and dissemination of their financial information. Financial privacy includes not only bank secrecy but also data protection regulations, identity theft prevention measures, and individual privacy rights in financial services.

Despite bank secrecy being a tradition in some countries, in recent years, there has been pressure to conform to international standards of transparency

Switzerland has long been synonymous with bank secrecy, thanks to its strict banking confidentiality laws and a tradition of safeguarding clients' privacy. However, in recent years, Switzerland has taken steps to align with international transparency standards, such as participating in the OECD's Common Reporting Standard (CRS) and revising its banking laws to allow for greater cooperation in tax and financial crime investigations.

Luxembourg, a small European country, has historically been known for its strong bank secrecy laws and as a hub for international wealth management. However, like Switzerland, Luxembourg has adapted its legislation in response to international pressure, adopting the CRS and easing some of its bank secrecy provisions.

Liechtenstein, another small European country, has also been recognized for its strict bank secrecy laws. Over the past decade, Liechtenstein has undergone significant reforms to increase financial transparency and comply with international standards. Despite these changes, Liechtenstein still offers a high level of privacy for clients, and its banks are known for their discretion and commitment to client confidentiality.

The FATF was responsible for introducing robust standards and measures to combat money laundering and terrorist financing

Established in 1989, the Financial Action Task Force (FATF) is an intergovernmental body that aims to combat money laundering, terrorist financing, and other threats to the integrity of the global financial system. The FATF has introduced a series of recommendations and standards that countries worldwide have widely adopted. These standards require financial institutions to implement robust anti-money laundering (AML) and counter-terrorist financing (CTF) measures, significantly impacting the traditional practice of bank secrecy.

The OECD, an international organization that promotes economic growth and cooperation, has played a crucial role in transforming the landscape of bank secrecy. Through its initiatives to combat tax evasion and promote transparency, the OECD has facilitated the adoption of information exchange agreements and the development of global tax standards, further eroding bank secrecy.

FATCA requires foreign financial institutions to report information about accounts held by US taxpayers to the IRS

Launched by the OECD in 2014, the Common Reporting Standard (CRS) is a global initiative to promote an automatic exchange of financial account information between participating countries. Under CRS, financial institutions in participating jurisdictions are required to collect and report financial account information of non-resident individuals and entities to their local tax authorities, which is then shared with the relevant foreign tax authorities. This has significantly diminished the appeal of traditional bank secrecy jurisdictions for tax evasion purposes.

Enacted in 2010 by the United States, FATCA is legislation aimed at preventing tax evasion by U.S. citizens and residents holding financial assets in foreign accounts. FATCA requires foreign financial institutions to report information about accounts held by U.S. taxpayers to the Internal Revenue Service (IRS). In response, many countries have entered into intergovernmental agreements (IGAs) with the United States to facilitate tax information exchange, further undermining bank secrecy.

Growing global pressure to increase transparency and cooperation in combating financial crime

In 2016, the Panama Papers leak exposed a vast network of offshore companies, shell corporations, and hidden financial transactions, implicating numerous politicians, business leaders, and celebrities.

Although it was Panama that got tarnished by these leaks, it was actually the individuals from other countries who were breaking the law and not reporting what should have been reported.

Related content: What Is The Panama Private Interest Foundation?

The Paradise Papers, leaked in 2017, similarly revealed a complex web of offshore tax havens and financial dealings involving prominent individuals and corporations. The scandal added to the growing global pressure on jurisdictions with bank secrecy laws to increase transparency and cooperation in combating financial crimes.

Blockchain technology can provide secure and transparent platforms, preserving privacy for financial transactions

In recent years, strict bank secrecy laws have significantly declined due to international efforts to promote financial transparency and combat financial crimes. Many traditional bank secrecy jurisdictions have revised their legislation to comply with global standards and to participate in information exchange agreements, such as the CRS and FATCA. The erosion of bank secrecy has diminished the appeal of these jurisdictions for tax evasion and other illicit financial activities.

Technology has played a crucial role in promoting financial transparency and challenging the traditional concept of bank secrecy. Advances in digital communication, data analytics, and cybersecurity have facilitated the sharing of financial information between tax authorities and financial institutions across borders. Additionally, the rise of fintech solutions and digital currencies has created new channels for financial transactions, prompting regulators to adapt their rules and oversight to maintain transparency and prevent abuse.

Despite the decline in bank secrecy, a few jurisdictions still offer higher levels of confidentiality to clients. However, these secrecy havens face increasing international pressure to comply with transparency standards, and their limitations have become more apparent. For instance, being labelled as non-cooperative by international organizations such as the FATF or the OECD can lead to reputational damage, economic sanctions, or exclusion from the global financial system, reducing the attractiveness of these jurisdictions for legitimate clients.

The ongoing tension between individual privacy rights and the push for global financial transparency will likely shape the future of financial privacy. As technology evolves, new solutions that balance these competing interests may emerge. For example, using blockchain technology and other decentralized systems could provide secure, transparent, and privacy-preserving platforms for financial transactions. Ultimately, the future of financial privacy will depend on the ability of regulators, financial institutions, and individuals to adapt to the changing landscape and address the ethical, legal, and technological challenges posed by the evolving concept of bank secrecy.

Banking secrecy has historically been a competitive advantage for some countries, attracting capital and foreign investment

Proponents of bank secrecy argue that it is essential to protect the privacy rights of individuals, as confidentiality is a fundamental aspect of the client-bank relationship. They maintain that individuals have the right to control access to their personal and financial information and should not be subject to unwarranted scrutiny or surveillance by governments or third parties.

Bank secrecy has historically been a competitive advantage for certain jurisdictions, attracting foreign capital and investments. Supporters argue that maintaining secrecy can help jurisdictions create favourable business environments, leading to increased economic growth, job creation, and a more stable financial system.

Opponents of bank secrecy argue that it hinders global efforts to promote financial transparency and combat related crimes

Critics of bank secrecy contend that it can facilitate financial crimes, such as tax evasion, money laundering, and the financing of terrorism. By providing a cloak of anonymity, bank secrecy can enable corrupt individuals and organizations to hide their illicit activities and escape detection by law enforcement authorities.

Opponents of bank secrecy also argue that it hinders global efforts to promote financial transparency and combat financial crimes. Strict bank secrecy laws can impede international cooperation and information sharing between tax authorities, financial institutions, and law enforcement agencies, making investigating and prosecuting financial criminals difficult. In this context, critics assert that dismantling bank secrecy is necessary to create a more transparent, accountable, and equitable global financial system.

Everyone should look for a way to protect their wealth and lower their taxes, bank secrecy is a legal tool, and you should use it while you can.

Banking secrecy protections are slowly being eroded as governments at various levels put individual privacy under false pretenses.

Countries that do not abide by global rules are punished and sanctioned until they change their policies. This leaves a grim outlook on the future of financial privacy, as more and more governments are allowed to access information about your assets and, in some cases, seize them for their own gains. Governments can learn a lot about you by analyzing your spending habits.

Bank secrecy is an important tool for keeping individuals' personal and financial information private, especially for the protection of assets. Everyone should look for ways to protect their wealth and reduce their tax burden, and bank secrecy is a legal tool that individuals can use. A contractual clause between banks and their customers should be respected over any regulation.

If you want the best intel from the expat world, including profitable offshore opportunities, little-known tax-saving strategies, and hard-won insights on immigration, passports, and Plan-B residencies, all delivered to your inbox every single week, then join our daily correspondence, EMS Pulse®. Currently enjoyed by over 84,000 expats and expat-hopefuls worldwide. Fill in the form below to join our newsletter free:

Written by Mikkel Thorup

Mikkel Thorup is the world’s most sought-after expat consultant. He focuses on helping high-net-worth private clients to legally mitigate tax liabilities, obtain a second residency and citizenship, and assemble a portfolio of foreign investments including international real estate, timber plantations, agricultural land and other hard-money tangible assets. Mikkel is the Founder and CEO at Expat Money®, a private consulting firm started in 2017. He hosts the popular weekly podcast, the Expat Money Show, and wrote the definitive #1-Best Selling book Expat Secrets - How To Pay Zero Taxes, Live Overseas And Make Giant Piles Of Money, and his second book: Expats Guide On Moving To Mexico.

Panama’s geographic size is modest, but its global relevance is not. The country connects two oceans and two continents, operates on a dollarized...

Honduras’ newly elected president, Nasry Asfura of the conservative National Party, was sworn in on January 27, 2026. The election, held on November...

For a growing number of Americans, cost-of-living math no longer works. Housing feels harder to reach, everyday costs keep climbing, and long-term...