Top Things To Do In Panama In 2026

Panama’s geographic size is modest, but its global relevance is not. The country connects two oceans and two continents, operates on a dollarized...

5 min read

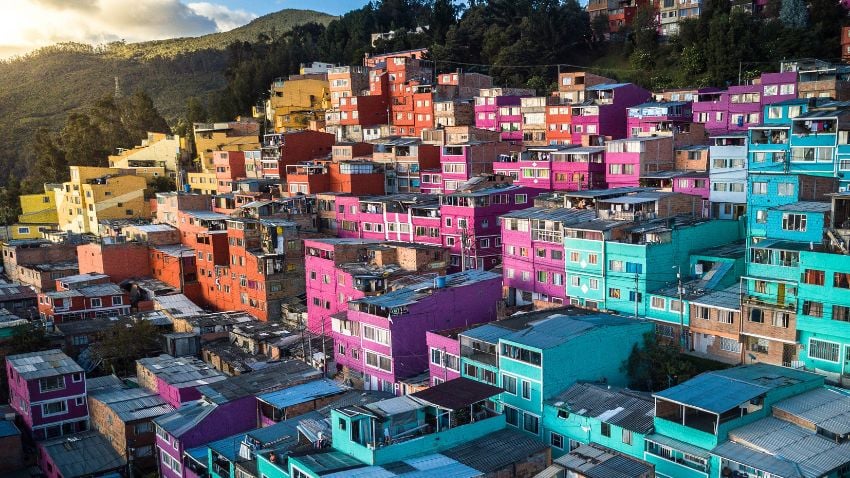

Colombia is an ideal place to retire because of its natural attractions, lower cost of living, and because it has become safer for tourists in recent years. Colombia’s government has been focusing on increasingly promoting Colombia as an ecotourism destination for Western tourists. Colombia has multiple attractions, including coffee plantations, coastal towns, islands, national parks, and other outdoor attractions.

Colombia offers a plethora of options to consider if you're contemplating retiring in this South American nation. The country's diverse cities and regions cater to a wide range of lifestyles and preferences. From the vibrant urban life of Medellín to the historical charm of Cartagena, retirees can choose a place that resonates with their interests and desires. The climate in Colombia varies from tropical beach towns to temperate highlands, ensuring that there's a perfect spot for everyone to enjoy the weather that suits them best throughout the year.

One of the most appealing aspects of retiring in Colombia is the affordable cost of living. Housing, utilities, and food are reasonably priced, making it an attractive option for retirees seeking to stretch their retirement funds. This affordability allows retirees to enjoy a comfortable life without straining their budgets.

Colombia is also known for its excellent healthcare system, which provides world-class medical care at a fraction of the cost compared to many Western countries. Access to quality healthcare services is a significant benefit for retirees, and the presence of English-speaking medical professionals adds to the convenience.

An aerial shot of Colpatria Tower during sunset in Bogota, Colombia

Many countries in the region, including Argentina and Peru, make it very easy for retired people who want to gain residency. If you are retired and want to call Colombia your new home, then there are three viable options for you to consider. Two of these options involve investing in real estate or a local business, and the investment amount is very modest. However, most expats from Western countries will qualify based on their pension and will not be required to invest in Colombia.

When considering retirement in Colombia, it's essential to explore the visa options available. Obtaining a resident visa often requires providing specific documents, such as proof of income or investments, so it's crucial to thoroughly research the visa application process and requirements.

Colombia's rich history, diverse culture, and welcoming locals create an enriching environment for retirees. You can immerse yourself in the vibrant music, arts, and culinary scenes, and even embark on a journey to learn the Spanish language, enhancing your overall experience.

Safety has improved significantly in Colombia in recent years, and while some areas may require more caution than others, many cities are now considered safe for expats. The presence of robust internet and utilities services ensures that retirees can stay connected and comfortable in their chosen retirement location.

Retiring in Colombia offers a wealth of possibilities, from diverse climates and affordable living to excellent healthcare and a rich cultural scene. While it's essential to research visa requirements and safety conditions in specific areas, Colombia presents a compelling option for retirees seeking an exciting and affordable retirement destination.

Cartagena panoramic view, Colombia

Colombia also has an excellent option for retirees who don’t want to invest in real estate. The Colombian government created the M11 visa in 2017, which allowed retirees to live in Colombia for up to three years. Before 2017, the visa was only valid for one year, and applicants had to renew it yearly if they wanted to stay longer. One benefit of this visa program is that the minimum income requirements are meagre. As of 2022, you only need to prove that you have a monthly income of $750 to be eligible. This amount is equivalent to 3 times the minimum wage in Colombia, so it could increase slightly in the future. Living in Colombia with this amount of money should be easy, although you may need to move to a smaller city or rent a studio apartment to live comfortably. Renting 2-3 bedroom apartments can cost as low as $500 USD/month, and the average net salary in Colombia is only around $350 USD/month. You can also invest in Colombia as a retiree for those interested in investing and obtaining more profits.

Guatape, Colombia

Colombia provides an excellent opportunity for foreigners who want to gain residency in Colombia by investing in businesses. This option can be very suitable for retired people who want to make a passive investment so they can live in Colombia. Compared to programs in other countries, this option does not require the owner to manage the company actively.

The best visa to consider if you want to go this route is the Partner Entrepreneur Business Investment Visa. This visa requires you to invest the equivalent of around 100 times the minimum wage in Colombia, which is currently around $24,000 USD. You will need to remain in Colombia for more than six months every year to retain this visa, and you will be able to stay for up to three years. Other requirements include providing proof of health insurance during your stay and completing a criminal background check.

If you are interested in permanent residency in Colombia, you must invest more significantly. An investment of 650 times the monthly minimum wage, which is around $160,000 USD, will allow you to be a resident of Colombia for five years and then apply for permanent residency afterward.

Related content: Colombia Elects A Socialist And What It Means For Expats.

El yardarm, Guatape, Colombia

However, most people who want to retire in Colombia would prefer to invest in real estate instead of having to invest in a company. You can invest 650 times the minimum monthly wage in Colombia in real estate, instead of a company, to become a permanent resident of Colombia. Currently, this amount is around $160,000 USD, but this amount will increase in line with the country’s minimum wage.

This investment option is excellent for retirees who plan to stay more than five years and not worry about renting apartments. Colombia is also great for searching for real estate bargains and buying multiple apartments to rent to other people. When purchasing real estate, you can either buy the property in your name or set up a legal entity that owns multiple apartments you rent to other people.

The only downside of investing in real estate in Colombia is that the process is complicated, and there are extra fees that you have to pay. Furthermore, you should hire a lawyer to assist with things like a title search and background check.

Related content: The Basics Of How To Get A Second Passport Or A Second Residency.

%20in%20Colombia%20is%20considered%20the%20most%20beautiful%20river%20in%20the%20world.jpg?width=850&height=478&name=Ca%C3%B1o%20Cristales%20(Crystal%20River)%20in%20Colombia%20is%20considered%20the%20most%20beautiful%20river%20in%20the%20world.jpg)

Caño Cristales (Crystal River) in Colombia

People from most Western countries, including the United States, can enter Colombia on a 90-day tourist visa and then leave the country and enter again. This can be an acceptable short-term solution but is not ideal if you want to spend more than six months in Colombia yearly. The application process for retirees has become much easier now. Unlike in the past, you can apply to live in Colombia for three years instead of just one year.

View of a small Colombian fishing village and hippie paradise called Taganga

Colombia is an attractive place to look into for retirement. The requirements are low, investing is optional, and you will benefit greatly from your dollars. There are many natural spots to explore or relax while living there. The best part is that many different easy ways to obtain a retirement visa in Colombia exist.

Colombia. is one of the most attractive options for retirees. The minimum income requirements for this retirement visa are extremely low and allows to stay in Colombia for three years with this option. If you want to become a permanent resident of Colombia and have money to invest, then investing in real estate is one of the best options. On the other hand, the Colombia investors visa is attractive because of the low investment amount, but it takes more work to become a permanent resident this way. If you can't invest in real estate, applying based on your social security or pension is best.

If you want the best intel from the expat world, including profitable offshore opportunities, little-known tax-saving strategies, and hard-won insights on immigration, passports, and Plan-B residencies, all delivered to your inbox every single week, then join our daily correspondence, EMS Pulse®. Currently enjoyed by over 84,000 expats and expat-hopefuls worldwide. Fill in the form below to join our newsletter free:

Written by Mikkel Thorup

Mikkel Thorup is the world’s most sought-after expat consultant. He focuses on helping high-net-worth private clients to legally mitigate tax liabilities, obtain a second residency and citizenship, and assemble a portfolio of foreign investments including international real estate, timber plantations, agricultural land and other hard-money tangible assets. Mikkel is the Founder and CEO at Expat Money®, a private consulting firm started in 2017. He hosts the popular weekly podcast, the Expat Money Show, and wrote the definitive #1-Best Selling book Expat Secrets - How To Pay Zero Taxes, Live Overseas And Make Giant Piles Of Money, and his second book: Expats Guide On Moving To Mexico.

Panama’s geographic size is modest, but its global relevance is not. The country connects two oceans and two continents, operates on a dollarized...

Honduras’ newly elected president, Nasry Asfura of the conservative National Party, was sworn in on January 27, 2026. The election, held on November...

For a growing number of Americans, cost-of-living math no longer works. Housing feels harder to reach, everyday costs keep climbing, and long-term...