How Safe Is Costa Rica?

Costa Rica has become one of the most popular expat and digital nomad destinations in Latin America, known for its natural beauty, relaxed lifestyle,...

11 min read

In Ayn Rand's seminal work "Atlas Shrugged," the world's most talented and productive individuals, fed up with an oppressive and anti-capitalist system, choose to leave everything behind in search of freedom and recognition for their achievements. Today, a similar scenario unfolds as America's wealthiest citizens, driven by the same desire for liberty and opportunity, outflow the USA for more welcoming environments. This search for emigration is not just about the movement of wealth; it reflects a broader rejection of an increasingly intrusive and unpredictable political environment. Much like the protagonists of Rand's novel, these modern-day Atlases are shrugging off the burdens of overregulation and high taxation, seeking instead the freedom to thrive in more favourable economic and political climates. Their journey underscores a profound shift in global economic dynamics and highlights the urgent need for policy reform within the United States.

Understanding the migration patterns of millionaires worldwide goes beyond merely monitoring the flow of wealth. It involves closely observing the dynamic changes in global economics, stability, and opportunities. Millionaire migration data provides valuable insights into the destination choices of the world's affluent population, offering a glimpse into the economic conditions and opportunities in various regions.

The annual USA Wealth Report by Henley & Partners provides a comprehensive analysis of the movement of high-net-worth individuals (HNWIs), specifically emphasizing their migration patterns in and out of the United States. This report utilizes a database to provide a detailed and reliable snapshot of the movements of the world's wealthy individuals. The significance of the USA Wealth Reports goes far beyond just the statistics. The reflection of underlying global trends encompasses political stability, economic opportunities, and the desirability of different countries as places to live and do business. It also provides many insights into what is going wrong in the US.

American millionaires are increasingly seeking second citizenship and residences abroad, reflecting a significant shift in global mobility trends among the affluent

The migration patterns of American millionaires have seen notable shifts, with an increasing number of the country's wealthiest individuals seeking second citizenship or residences abroad. This trend underscores a growing global mobility among the affluent, driven by various socio-economic factors, from seeking political stability to diversifying investment opportunities.

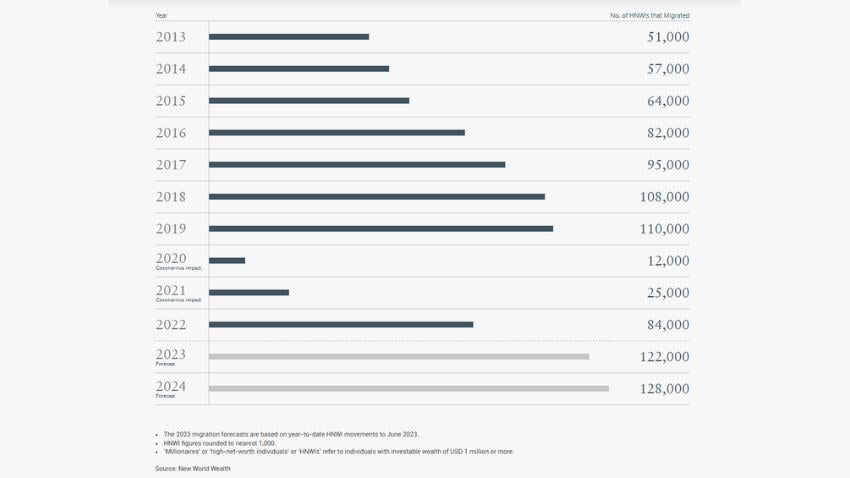

According to the USA Wealth Report 2024, approximately 120,000 high-net-worth individuals (HNWIs)—those with over $1 million in liquid investable assets—relocated internationally last year. This figure is expected to rise to 128,000 in 2024. To put this trend in perspective, only 51,000 millionaires moved to other countries in 2013.

The report explains that Americans are the most prominent millionaires looking for a second passport or alternative residency. In 2023, a record-setting year, inquiries from American clients surged by 504% compared to 2019, according to the data of Henley & Partners. This significant interest indicates a proactive approach by many to secure their international mobility and financial flexibility.

Given the substantial proportion and influence of millionaires residing in the US relative to the global total, this is a significant indicator of an emerging trend. According to the USA Wealth Report 2024, the US holds 32% of the global liquid investable wealth, amounting to USD 67 trillion. The United States also resides with 37% of the world's millionaires, totalling approximately 5.5 million high-net-worth individuals (HNWIs), each with over USD 1 million in liquid assets. This figure has grown by an impressive 62% over the last decade, significantly outpacing the global growth rate of 38%.

Net millionaire inflows to the US in 2023 lag countries like Singapore and the United Arab Emirates. While the U.S. saw a decline in high-net-worth individual inflows during the pandemic, it rebounded with a net inflow of 2,200 (this is the updated number in USA Wealth Report 2024) millionaires in 2023, up from 1,500 in 2022. Based on current trends, the USA Wealth Report 2024 projects a net increase of over 3,500 millionaires in 2024. However, these numbers still fall short of the annual peaks of 5,000+ seen before 2019, indicating that the U.S. may be losing its status as a premier destination for millionaires.

Nevertheless, some wealthy technology entrepreneurs, particularly from Asia, Europe and the UK, are migrating to the US. This is mainly because innovation centres such as Silicon Valley and Austin continue to attract critical human capital, stimulating technological advances. Many millionaires attracted to the US are more interested in the robust high-tech market than in the country's political, legal, or economic climate. Conversely, American millionaires are migrating to states with lower taxes, such as Florida and Texas, highlighting a domestic shift towards more favourable fiscal environments.

On the other hand, U.S. millionaires are venturing out of American borders in search of new opportunities, which contrasts the inflows. The migration out of the U.S. is not on a mass scale but is significant enough to note a rising trend in establishing residences or citizenships in other countries. This dynamic reflects a strategic diversification of bases, possibly due to concerns over domestic policies, taxation, or simply the allure of a more favourable lifestyle elsewhere.

According to Henley & Partners' estimates, Australia led the way with a net inflow of 5,200 millionaires in 2023. The United Arab Emirates followed closely behind, attracting 4,500 millionaires. Singapore ranked third with a net inflow of 3,200 millionaires, while the United States ranked fourth with 2,100 millionaires moving here.

This contrasting dynamic of substantial inflows and noteworthy outflows of millionaires gives us a nuanced view of the U.S. as both a destination and a departure point in the global landscape of millionaire migration. These trends offer a window into the priorities and concerns of the wealthy and the ongoing appeal of the US as a land of opportunity.

A global analysis reveals that millionaires are seeking countries that offer better financial opportunities and enhanced lifestyles. Henley & Partners' estimates for 2022 and 2023 provide valuable insights into this trend. The graph below presents estimated figures for the countries experiencing the highest net outflow of millionaires in 2022 and 2023.

In China, 10,800 millionaires were estimated to have emigrated in 2022, with forecasts indicating an increase to 13,500 in 2023. India saw an estimated 7,500 millionaires leave in 2022, with a forecasted decrease to 6,500 in 2023. The United Kingdom had an estimated 1,600 millionaires emigrate in 2022, with projections suggesting a rise to 3,200 in 2023. Russia experienced an estimated 8,500 millionaire departures in 2022, with forecasts predicting a drop to 3,000 in 2023. Hong Kong had an estimated 2,400 millionaires emigrate in 2022, with projections indicating a decrease to 1,000 in 2023. South Korea saw an estimated 400 millionaires leave in 2022, with forecasts suggesting a doubling to 800 in 2023.

Source: Henley Private Wealth Migration Dashboard 2023

Millionaires seeking better financial opportunities and political stability are driving a new global trend. The graph below highlights some of the countries losing out due to this trend, which is intensifying each year. Although the net inflow of millionaires to the US remains positive, it is likely that the US will soon be among the countries negatively impacted by this shift.

Wealthy Americans increasingly seek backup citizenship or residence abroad, indicating declining faith in the domestic outlook. Many are diversifying their domiciles across the Caribbean, Europe, and beyond. Popular destinations for Americans include Portugal, Malta, Spain, Switzerland, and Greece, driven by motives such as mitigating political risk, accessing business opportunities, seeking lower taxes, and enhancing global mobility.

Migration to the United Arab Emirates (UAE) surged dramatically in 2022, with an estimated 5,200 millionaires relocating to the country, marking a historic peak. This trend continued into 2023, with around 4,500 millionaires estimated to have made the UAE their new home. These figures are particularly striking for the UAE, which typically welcomes approximately 1,000 high-net-worth individuals annually. Noteworthy is the diverse pool of interest in the UAE, spanning from India, the UK, Russia, Lebanon, Pakistan, Turkey, Egypt, South Africa, Nigeria, Hong Kong, and China, with Americans now joining the ranks of prospective migrants. Having lived in the Middle East for eight years, especially in Abu Dhabi, I understand why the UAE's enticing financial opportunities appeal to millionaires.

Across Asia, Singapore was the destination of choice for millionaires in 2022. Singapore, which has a population of approximately 6 million and a GDP of USD 673 billion, attracted an estimated 2,900 millionaires in 2022 and an estimated 3,200 millionaires in 2023. Singapore, with its business-friendly economic system, mild taxes, and reliable political system, is way more welcoming than the US.

Switzerland deserves mention, too, consistently attracting newcomers while maintaining its stature as Europe's foremost wealth center. Switzerland attracted an estimated 2,200 millionaires in 2022 and 1,800 in 2023. With a population of around 9 million and a GDP of USD 639 billion (2023), Switzerland owes its success to sound economic policies, its commitment to free markets and the political stability it offers its citizens.

With a GDP of $27.36 trillion and a population of approximately 335 million, the estimated number of millionaires attracted by the USA in 2022 is 1,500, while the estimated number in 2023 is 2,100 millionaires. Thus, considering population and GDP, the aforementioned small countries significantly outperform the U.S. in attracting millionaires.

In addition to millionaires leaving the US, it is also necessary to consider millionaires relocating within the country. Most millionaires prefer to move to states within the country rather than leave the USA altogether. According to Henley & Partners, cities like Austin, Miami, and Scottsdale are gaining residents, while traditional hubs like Los Angeles, New York, and Chicago see modest declines. A steady stream of skilled immigrants pursuing the American dream supports the net inflow. While the US remains a land of opportunity, concerns about institutional corruption and governmental failures are prompting doubts about future prosperity.

Dual citizenship among Americans is rising as they seek to escape high taxation and find more favourable fiscal environments abroad

In the past, many Americans viewed dual citizenship as morally wrong or something very unusual. However, there has been a significant change in this viewpoint recently. Today, Americans see significant advantages in holding additional citizenship, such as enhanced global mobility and insurance against political instability. Two significant disruptions explain this shift: the Covid-19 restrictions and increasing political unrest in the US. During lockdowns, the pandemic highlighted the limitations of premium passports like the US passport. Indeed, the COVID-19 restrictions have highlighted the fundamental importance of citizenship and the right to enter countries.

The growing political unrest in the US has prompted many Americans to seek an exit strategy. Dual citizenship has become a form of political risk insurance, driving a surge in efforts to secure additional citizenships. Those with eligible ancestry pursue EU citizenship, while wealthier individuals explore citizenship by investment as part of their wealth planning. This trend is not new to the rest of the world. Citizens of less stable countries have long sought additional citizenships for better security and opportunities. For example, many Latin Americans have obtained Italian and Spanish citizenship based on ancestry to escape economic crises. Wealthy individuals from countries without visa waiver privileges have driven demand for premium citizenship through investment programs. The growing interest among Americans will further solidify the trend toward dual citizenship, making it an increasingly common and strategic choice globally.

A constellation of factors influences millionaires' decisions to leave the United States, each playing into the broader narrative of seeking more stability and opportunity beyond American shores. As detailed in the USA Wealth Reports, these reasons outline a clear picture of the drivers behind this notable trend.

The current political environment and rising societal tensions in the US significantly contribute to the migration of millionaires. The polarized political system, characterized by frequent policy and regulatory uncertainty shifts, prompts long-term stability and governance concerns. This volatility can be particularly unsettling for high-net-worth individuals who seek a predictable and secure environment to operate businesses and manage wealth.

Moreover, the increasing societal tensions, including debates over wealth inequality, social justice movements, and political protests, create an atmosphere of unrest that can deter affluent individuals. These societal pressures often manifest in calls for higher taxation and more stringent regulations, which can be seen as punitive to success and entrepreneurship.

The growing inclination towards governmental intervention and redistribution policies is especially troubling for those who value personal freedom, property rights, and economic autonomy. The erosion of these fundamental principles compels many millionaires to seek refuge in countries that uphold and protect individual liberties. In these destinations, they find financial incentives and societal respect for the autonomy and achievements of the individual.

Successful and productive people frequently face accusations from progressive-leftist groups. These accusations often frame the affluent as the root cause of social issues. High-net-worth individuals are frequently portrayed as exploiting the system to accumulate wealth at the expense of the broader populace. Such rhetoric can lead to policies that are perceived as punitive, including aggressive tax hikes and increased regulatory burdens aimed specifically at the wealthy.

This narrative and policy actions reflecting these sentiments foster an increasingly hostile environment to the affluent. As a result, millionaires are incentivized to relocate to countries where the political discourse is less adversarial towards wealth and success. These countries offer a more predictable regulatory framework, protection of property rights, and a culture that promotes and rewards entrepreneurial spirit and achievement.

Tax policy is an ever-present concern for the affluent. Recent discussions and changes in tax legislation, particularly those proposing higher taxes on the rich, have led some millionaires to seek domiciles in jurisdictions with more favourable tax regimes. This trend is often about more than just tax savings; it's also about finding locales that offer fiscal policies that enhance wealth preservation and growth.

Due to its aggressive tax regime, the United States has become increasingly undesirable for high-net-worth individuals. The current tax policies, which already impose significant burdens on the wealthy, are set to become even more stringent under Biden's proposed budget. High-net-worth individuals often seek jurisdictions with more favourable tax environments to preserve and grow their wealth, and the US is losing its appeal in this regard.

It is important to know that Biden's FY 2025 Budget Proposal seeks to increase the top marginal tax rate on individual income from 37% to 39.6%, bringing the combined marginal rate to approximately 45.1%. When factoring in Medicare taxes, the top rate could effectively rise to 47.6%, making it one of the highest in the OECD.

The proposal includes raising the corporate tax rate from 21% to 28%, resulting in a combined marginal rate of 32.2%, placing the United States among the countries with the highest corporate tax burdens within the OECD. Additionally, Biden's plan involves quadrupling the excise tax on stock buybacks from 1% to 4%, potentially discouraging companies from repurchasing their shares and instead shifting towards distributing dividends.

The capital gains tax rate is also targeted for a significant hike, potentially reaching 49.9% for high earners, the highest among OECD countries. This could discourage investment and innovation by imposing a hefty tax burden on returns. The increase in corporate and personal tax rates is seen as punitive to the most productive segments of society.

Many millionaires are looking globally for new business opportunities that aren't available in the U.S. This includes markets with emerging consumer bases or innovative sectors. Additionally, lifestyle considerations such as better healthcare, education, and general living conditions are increasingly important. Countries offering a high quality of life alongside business opportunities are beautiful.

These insights from leading figures in wealth migration underscore the strategic thinking behind millionaires' mobility, where diversifying domicile is not just a reactive measure but a proactive strategy for enhancing personal and financial security.

Switzerland remains a top destination for millionaires, thanks to its sound economic policies, free markets, and political stability

The migration of millionaires has far-reaching implications for the U.S. economy and on a global scale. The movement of high-net-worth individuals (HNWIs) can significantly impact real estate markets, investment trends, and the economic landscape of local businesses.

Millionaires significantly contribute to the U.S. real estate market, particularly in high-end luxury segments. However, their migration from major cities like New York, Los Angeles, and Chicago can lead to fluctuations in property values and alter local real estate markets. Their departure could reduce capital available for local startups, businesses, and other investment opportunities, potentially impacting innovation and growth in technology, healthcare, and green energy sectors.

Their lifestyle spending supports local businesses, so their migration could reduce revenue, impacting employment and available services. As millionaires redistribute their wealth, countries receiving them may experience enhanced economic growth and increased international visibility. This shift could also lead to changes in global banking, finance, and real estate markets.

The UAE's surge in millionaire migration, with a historic peak of 5,200 in 2022, underscores its growing appeal to a diverse, global, high-net-worth population

The changing patterns of high-net-worth individuals relocating highlight underlying divisions within the American dream, mirroring a story of government failures and institutional decline. Millionaires exploring opportunities outside the United States reflect a lack of faith in the country's future, influenced by worries about increasing taxes and declining economic efficiency. This migration signals a broader narrative of dissatisfaction, where the affluent seek environments that offer greater economic stability and predictability.

However, the departure of wealthy individuals from the US is not just a matter of economics. It is a poignant reflection of a more widespread discontent with the status quo, a discontent that is deeply rooted in the country's political turmoil and social divisions. These individuals are not just seeking alternative citizenship or residencies abroad for convenience but as a strategic response to what they perceive as governance and stability issues. The US is losing its appeal among these affluent individuals, who are now seeking jurisdictions with more favourable tax climates and regulatory environments. This shift in perspective represents not merely a change but a profound reevaluation of values prioritizing economic freedom and personal independence over traditional loyalty to a specific country.

If you're a high-net-worth individual considering leaving the U.S., subscribe to our newsletter to stay updated and guarantee your free Special Report on Plan-B Residencies & Instant Citizenships. In these unpredictable times, obtaining a second passport can offer unmatched financial and political stability, protecting your wealth and lifestyle. Our experts will guide you through finding the best options tailored to your needs. Don't wait until it's too late—contact us today to discover how a second citizenship can secure your future and ensure your prosperity.

If you want the best intel from the expat world, including profitable offshore opportunities, little-known tax-saving strategies, and hard-won insights on immigration, passports, and Plan-B residencies, all delivered to your inbox every single week, then join our daily correspondence, EMS Pulse®. Currently enjoyed by over 84,000 expats and expat-hopefuls worldwide. Fill in the form below to join our newsletter free:

Written by Mikkel Thorup

Mikkel Thorup is the world’s most sought-after expat consultant. He focuses on helping high-net-worth private clients to legally mitigate tax liabilities, obtain a second residency and citizenship, and assemble a portfolio of foreign investments including international real estate, timber plantations, agricultural land and other hard-money tangible assets. Mikkel is the Founder and CEO at Expat Money®, a private consulting firm started in 2017. He hosts the popular weekly podcast, the Expat Money Show, and wrote the definitive #1-Best Selling book Expat Secrets - How To Pay Zero Taxes, Live Overseas And Make Giant Piles Of Money, and his second book: Expats Guide On Moving To Mexico.

Costa Rica has become one of the most popular expat and digital nomad destinations in Latin America, known for its natural beauty, relaxed lifestyle,...

Mexico remains one of Latin America’s most compelling destinations, especially for North Americans. More than a million expats call it home, and tens...

South Korea is far more than K-pop and K-dramas. It is a country known for outstanding food, from bustling street markets to high-end dining, as well...