Latin America’s Rightward Shift Continues In Honduras

Honduras’ newly elected president, Nasry Asfura of the conservative National Party, was sworn in on January 27, 2026. The election, held on November...

5 min read

An expatriate needs to consider many issues before choosing a residence. This is important to ensure that the overseas experience is the best and most advantageous possible. Therefore, it is worth checking the destination's economic freedom level, political stability, human development indices, tax system, and quality of life.

These are just a few indicators that serve as a thermometer when choosing your destination. Andorra is a country that shows advantages in all these areas for those looking for a residence abroad, and we will help you on this new path.

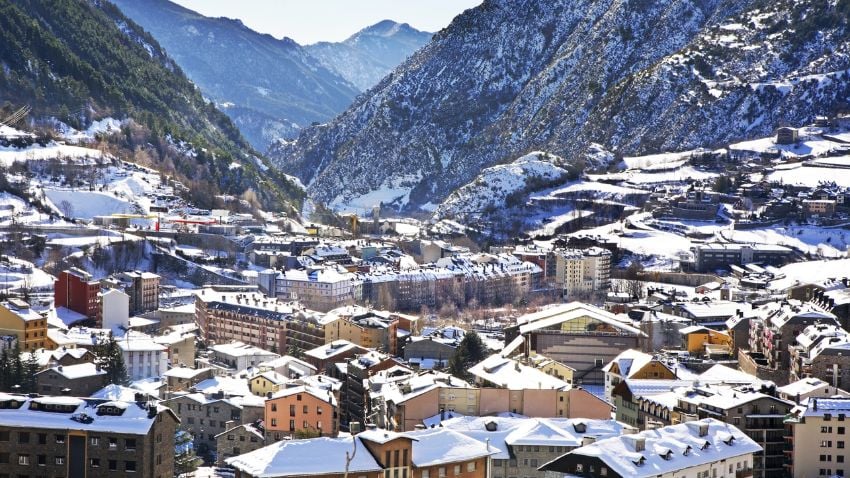

Andorra has beautiful mountains and many natural beauties

Andorra is located between two major European countries, France and Spain. This country is one of the smallest countries in the world and occupies only 468 km². Located in the Pyrenees, Andorra has beautiful mountains in its scenery and many natural beauties.

Although geographically located in the heart of Europe, this country is not part of the European Union, which makes it a special place within its geographic space. Andorra is a multilingual nation, and its currency is the euro.

Related content: The Basics Of How To Get A Second Passport Or A Second Residency

In addition to not participating in the European Union, Andorra is also not part of the Schengen Treaty. Therefore, its citizens, tourists, and residents do not have free circulation in the European countries that have adhered to the treaty.

However, Andorra has free circulation agreements with Spain and France, which facilitate the entry of EU citizens without the need for visas or special procedures.

Andorra neither belongs to the European Union nor is in the Schengen Area

Not being part of the European Union or a member of the Schengen Treaty may seem like a disadvantage. However, this has not prevented the full development of Andorra, which has a lot to offer its citizens, visitors, and expatriates. So, here are some good reasons for you to choose Andorra as your second residence:

Andorra is a country that boasts a good position among the safest countries in the world. This is possible due to the low levels of crime, which are reflections of the country's stability. But it's not just that; the location that may seem disadvantaged helps maintain security in the country. Since monitoring borders are much easier.

Andorra delivers its citizens and expatriates a high quality of life with cutting-edge education, health and a safe, peaceful, and stable environment. All of this positively impacts the lives of those who have chosen the country to live in.

This small country in the Pyrenees has one of the highest life expectancies in the world, 84 years for men and 87 years for women. So, those living in Andorra have more time to enjoy all the natural beauties, culture, and advantages this country offers.

Related content: Upcoming Andorra Digital Nomad Visa

Andorra has one of the world's most developed economies

For the expatriate who wants a residence where they can have a quality of life, an open market, and enjoys all the benefits that one of the world's most developed economies has to offer, the residence options are

There is also a residence for admission to geriatric, medical, or therapeutic treatment centers that require requirements such as: residing in the country for a minimum of 90 days per year, not engaging in a professional activity or work and proving that they have the means to maintain themselves in the country.

You can get a residency with permission to work in Andorra

Active residency in Andorra is related to expatriates interested in working or performing some kind of professional activity in the country. Thus, it can be an active residence with authorization to work:

Each of these types of active residency may require specific documents at the time of application to prove that the expatriate meets the requirements to obtain it.

Except for the documents and special qualifications that each type of active residency may require, some requirements are general to all of them and must be presented by all applicants. So, see what they are:

Suppose the expatriate does not have an employment contract with an Andorran company. In that case, it is possible to present a foreign investment file and apply for active residency, provided that the other requirements for each type are met.

Retirees can take advantage of Andorra's Passive Residency by Investment

For those who want to reside in Andorra but are not interested in working or performing any professional activity in the country, passive residency is the best option. In addition, this may be the best route for high-net-worth individuals and expatriates seeking a second residence through investments.

Retirees and international businessmen can take advantage of this residency option to live in Andorra while receiving their pensions and conducting business outside the Andorran territory.

Related content: Best International SIM Cards For World Travellers

This residency model requires an investment of €600,000 ($649,062 USD) made by the expatriate in some specific assets, and some of them are:

If the investment is made in real estate, there is a requirement that at least one of them be worth more than €600,000 ($649,062 USD). However, if the investment is made in the Government Housing Fund, the investment amount is reduced to €400,000 ($423,410 USD).

The holder must deposit €47,500 ($50,280 USD) with AFA - Andorran Financial Authority - and €9,500 ($10,056 USD) for each dependent who enters the country as a non-working resident. The AFA deposit amounts are deducted from the investment amount.

Andorra allows the resident to live with their entire family

The quality of life, security, and free market that the country offers to its residents are excellent advantages for expatriates who have chosen Andorra as their destination. However, when becoming a resident of this country, they have rights such as:

In addition, the residency also entitles the expatriate to family reunification, allowing the resident to live with their entire family in a developed and safe country, provided that all requirements are met.

Andorra has one of the lowest tax rates in the world

Andorra is an attractive country in its own right, but another factor that increases its magnetism is the tax benefits it offers to its citizens and residents. The country has very low tax rates, one of the lowest in the world.

Andorra applies a maximum rate of 10% for personal income tax, with those who do not exceed the minimum income of €24,000 ($25,404 USD)being exempt. Regarding corporate taxes, the general rate is 10%. In addition, the country has a system of reductions for new businesses, exemptions, and special regimes that favour entrepreneurship.

Also, consumption taxes are levied through indirect taxes that can vary between 0%, 1%, 2.5%, and 9.5%, with a general rate of 4.5%.

Read more: What Is An International Business Corporation (IBC)

Andorra has special tax regimes that favour entrepreneurship

The Andorran tax system is a way to attract foreign capital to the country, and despite having trade agreements with the EU, which are essential for the organization of its borders, the country has complete freedom to set its laws. Thus, Andorra can offer lower rates than its neighbours.

The Andorran strategy has yielded results and is an excellent option for expatriates looking for a simpler and less demanding tax system, those who want to undertake or just escape the taxes of their home countries.

An expatriate will find in Andorra an amazing place to live

Andorra's small territorial size does not prevent it from having a well-developed economy and an open and independent market right in the heart of Europe. Its location and freedom are very attractive for those who want to obtain a second residence in a European country without having to submit to the tax burden practiced in most of its countries.

An expatriate will find in Andorra a conducive environment for their investments and enjoy a high quality of life alone or with family, a true refuge in the midst of the Pyrenees. So, count on us to help you get your residence in Andorra.

If you want the best intel from the expat world, including profitable offshore opportunities, little-known tax-saving strategies, and hard-won insights on immigration, passports, and Plan-B residencies, all delivered to your inbox every single week, then join our daily correspondence, EMS Pulse®. Currently enjoyed by over 84,000 expats and expat-hopefuls worldwide. Fill in the form below to join our newsletter free:

Written by Mikkel Thorup

Mikkel Thorup is the world’s most sought-after expat consultant. He focuses on helping high-net-worth private clients to legally mitigate tax liabilities, obtain a second residency and citizenship, and assemble a portfolio of foreign investments including international real estate, timber plantations, agricultural land and other hard-money tangible assets. Mikkel is the Founder and CEO at Expat Money®, a private consulting firm started in 2017. He hosts the popular weekly podcast, the Expat Money Show, and wrote the definitive #1-Best Selling book Expat Secrets - How To Pay Zero Taxes, Live Overseas And Make Giant Piles Of Money, and his second book: Expats Guide On Moving To Mexico.

Honduras’ newly elected president, Nasry Asfura of the conservative National Party, was sworn in on January 27, 2026. The election, held on November...

For a growing number of Americans, cost-of-living math no longer works. Housing feels harder to reach, everyday costs keep climbing, and long-term...

Costa Rica has become one of the most popular expat and digital nomad destinations in Latin America, known for its natural beauty, relaxed lifestyle,...