The 2025 Surge In Gold And Silver: Why It Matters For Expats

The first month of a new year is a good time to reflect on what worked and what we missed in the previous year. For me, 2025 was strong, and a...

The United Kingdom, once a global hub of economic freedom and opportunity, is losing its appeal with the world’s wealthiest individuals. High-net-worth individuals (HNWIs) are leaving in record numbers, driven by economic and moral factors. The UK’s punitive tax system—featuring high income, capital gains, and inheritance taxes—has made it one of the most tax-hostile nations in the developed world. At the same time, a growing "eat-the-rich" mentality demonizes success, punishing wealth creators rather than celebrating their contributions.

Beyond economics, personal freedoms are under attack. Free speech is eroded by "hate speech" laws, and self-defence rights are stripped away by draconian policies. Rising crime rates and a government more focused on policing speech than protecting citizens further exacerbate the problem.

Adding to the UK’s economic and social challenges is the growing instability of Prime Minister Keir Starmer’s government. This volatility undermines the government’s credibility and contributes to the perception that the UK is no longer a stable, predictable environment for investment and growth. This combination is the perfect wake-up call to build a stronger Plan-B.

This article explores the key reasons behind this exodus, from crushing taxes and overregulation to eroding freedoms and reckless foreign policy.

The UK’s safety crisis worsens: soaring violent crime, vandalism, and riots expose systemic failures. Citizens pay the price for restrictive laws and lack of protection

For decades, the UK’s non-dom tax status allowed individuals to shield foreign income, capital gains, and inheritance from excessive taxation, attracting global entrepreneurs and fostering economic growth. However, its abolition in April 2025 marks a turning point, forcing wealth creators to either restructure their finances or leave. The consequences are already clear: capital flight, business relocation, and a sharp decline in foreign investment.

The UK has become one of the most tax-hostile nations in the developed world. A top income tax rate of 45% discourages productivity, while capital gains taxes of up to 28% stifle investment. Inheritance taxes at 40% penalize generational wealth, and a corporate tax rate of 25% makes the UK globally uncompetitive. Combined with VAT, property taxes, and stealth tax increases, it is abundantly clear that the government views citizens as mere revenue sources. High taxation distorts incentives, misallocates resources, and ultimately shrinks the economy's productive capacity.

The regulatory environment is equally oppressive. A bloated bureaucracy imposes red tape and inefficiency, while high public spending drives ever-higher taxes.

Wealth creation is not a zero-sum game; entrepreneurs who succeed do so by providing value to others through voluntary exchange. By discouraging this process, the UK is undermining the very mechanism that drives economic progress and improves living standards.

The results are predictable: 9,500 high-net-worth individuals were expected to leave in 2024 alone, and over 10% of the nation’s centi-millionaires have already fled. This exodus leads to fewer jobs, less investment, and economic stagnation. By punishing wealth creation, the UK is killing the goose that lays the golden eggs, and the entire nation will suffer the consequences. The destructive effects of interventionism and the importance of economic freedom are a stark reminder that prosperity cannot be sustained in an environment that disincentivizes innovation, investment, and entrepreneurship.

Related content: Top 9 Countries With Little Or No Taxes

Broken glass, a police car, and a fractured society. The UK battles rising crime, riots, and eroding freedoms, leaving citizens unprotected and silenced

The UK’s safety is in decline, with mass migration overwhelming public services and infrastructure, leading to record levels of violent crime in cities like London, Manchester, and Birmingham. According to the Office for National Statistics (ONS), violent crime has risen by over 10% in the past five years, with knife crime hitting historic highs. In the UK, violent crime is defined as any act of violence against a person, including sexual offences. It can range from minor assaults to murder. In the year ending March 2024, there were approximately 50,500 offences involving a sharp instrument in England and Wales (excluding Greater Manchester). This statistic is 4.4% higher than in 2022/23. The 2024 summer riots further exposed the government’s inability to maintain public order, leaving citizens vulnerable.

Compounding the problem is the UK’s draconian approach to self-defence. Citizens cannot legally carry basic tools for protection, and strict gun control leaves law-abiding individuals defenceless against criminals. Meanwhile, police focus on policing speech, with over 120,000 "non-crime hate incidents" recorded in 2023, as highlighted by the Free Speech Union.

This lack of basic security reflects the consequences of government overreach. By disarming citizens and monopolizing security, the state creates dependency while failing to protect individuals. The right to self-defence is essential for a free society. The UK’s approach erodes personal freedoms and undermines social harmony, driving wealth creators and productive citizens to seek safer, freer alternatives.

The UK’s commitment to free speech is rapidly eroding. Broad and vague “hate speech” laws criminalize dissent and political criticism, with individuals arrested for social media posts critical of government policies or expressing controversial opinions. For example, Jordan Parlour and Tyler Kay were jailed for 20 months and three years, respectively, for posts “inciting racial hatred” during the 2024 riots, while Bernadette Spofforth was arrested for allegedly sharing misinformation about the Southport stabbing suspect.

These cases highlight how expressing “wrongthink” in the UK can lead to fines, job loss, or even imprisonment, creating an Orwellian environment where speech is tightly controlled. This approach is fundamentally incompatible with a free society, stifling open debate and individual expression.

Adding to this troubling trend, the UK has become one of the most surveilled nations in the world. Facial recognition, internet monitoring, and mass data collection have made privacy nearly impossible.

George Orwell’s warnings in 1984 now seem prophetic, as the UK appears determined to fulfill his dystopian vision of a society where the state monitors every word and action. The government’s heavy-handed approach to policing speech, combined with its expansive surveillance apparatus, creates an environment where citizens must constantly self-censor to avoid legal repercussions. This is not the hallmark of a free society but rather a warning of how quickly freedoms can be stripped away in the name of security and order.

As the UK escalates tensions with Russia, its people face hardship. Freedom-friendly nations like Panama and Paraguay offer a brighter, safer future

The UK government’s foreign policy is equally alarming. It has become one of the loudest voices pushing for continued war with Russia, providing billions in aid, weapons, and direct military support. Calls for increased NATO involvement bring the UK dangerously close to direct conflict. A government that gambles with total war is not one that rational individuals can trust.

Worse still, there is no democratic debate over these decisions. Citizens and businesses are forced to bear the consequences of higher taxes, inflation, and increased vulnerability to attack. Demonstrations or debates against the government are dealt with swiftly and harshly.

Related content: World War 3: Where Will Be Safe In A Global Conflict?

For those seeking to escape the UK’s decline, several options better align with the principles of economic freedom and individual liberty. Latin American nations like Panama and Paraguay have emerged as attractive alternatives, offering territorial tax systems that exempt foreign income from taxation. This policy not only encourages wealth accumulation but also respects the right of individuals to keep the fruits of their labour—a stark contrast to the UK’s punitive tax regime.

These countries also boast pro-business climates, with streamlined regulations and incentives for entrepreneurs and investors. Their growing economies provide opportunities for innovation and wealth creation. At the same time, lower living costs allow individuals to enjoy a higher quality of life without the financial strain experienced in the UK. Importantly, nations like Panama and Paraguay prioritize personal freedoms, avoiding the overreach and surveillance culture that has become pervasive in the UK.

Moreover, these countries are not entangled in the UK’s obsession with foreign conflicts or militarization. Instead, they focus on fostering stability, economic growth, and individual autonomy. By relocating to these freedom-friendly nations, individuals can escape the UK’s decline and reclaim their right to prosperity, security, and self-determination.

The UK’s instability and high taxes drive citizens to seek better lives abroad. Discover freedom-friendly alternatives and secure your future now

The UK is in decline—economically, socially, and politically. Its government, marked by the instability of Prime Minister Keir Starmer’s administration, is driving out its most productive citizens and businesses through punitive taxation, oppressive regulations, and a disregard for personal freedoms. For those who value financial security, autonomy, and peace, the choice is clear: leave and prosper or stay and suffer.

The time to act is now. Secure your future by exploring freedom-friendly alternatives and reclaiming the rights and opportunities the UK has taken from you. Subscribe to receive our free special report on “Plan-B Residencies & Instant Citizenships” and take the first step toward a brighter, freer future.

If you want the best intel from the expat world, including profitable offshore opportunities, little-known tax-saving strategies, and hard-won insights on immigration, passports, and Plan-B residencies, all delivered to your inbox every single week, then join our daily correspondence, EMS Pulse®. Currently enjoyed by over 84,000 expats and expat-hopefuls worldwide. Fill in the form below to join our newsletter free:

Written by Mikkel Thorup

Mikkel Thorup is the world’s most sought-after expat consultant. He focuses on helping high-net-worth private clients to legally mitigate tax liabilities, obtain a second residency and citizenship, and assemble a portfolio of foreign investments including international real estate, timber plantations, agricultural land and other hard-money tangible assets. Mikkel is the Founder and CEO at Expat Money®, a private consulting firm started in 2017. He hosts the popular weekly podcast, the Expat Money Show, and wrote the definitive #1-Best Selling book Expat Secrets - How To Pay Zero Taxes, Live Overseas And Make Giant Piles Of Money, and his second book: Expats Guide On Moving To Mexico.

The first month of a new year is a good time to reflect on what worked and what we missed in the previous year. For me, 2025 was strong, and a...

Let’s be honest: the famous American Dream is broken, and everyone knows it. Wages are stagnant, taxes are rising, and the cost of living is...

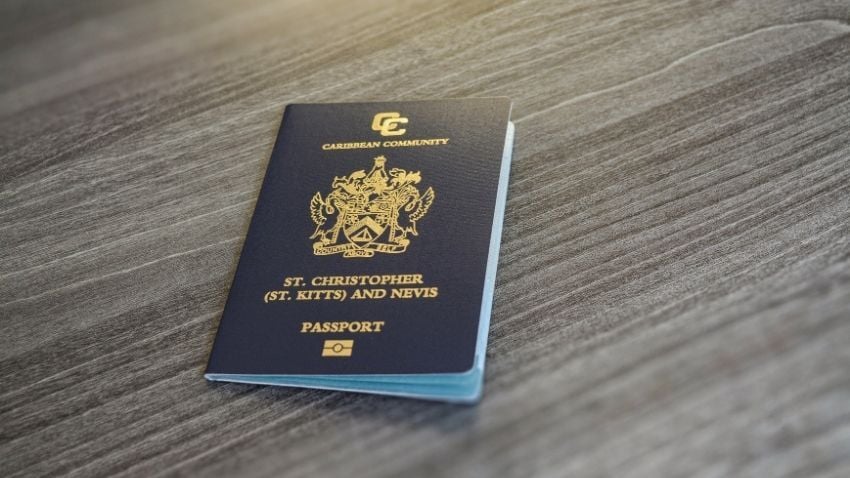

St. Kitts and Nevis has confirmed that its Citizenship by Investment Program will undergo a major restructuring beginning in 2026. If you’ve been...