How Expensive Is It To Live In Colombia?

Colombia inspires many thoughts and feelings. Some think of global pop icons like Shakira, J. Balvin, and Karol G. Others are drawn to the magical...

5 min read

As a Canadian, I have repeatedly warned about the structural problems of the Canadian dollar (CAD). Unfortunately, recent events have only confirmed these concerns. The Canadian dollar continues to lose value, and no concrete signs of recovery are on the horizon. Many Canadians insist on waiting for the CAD to rise before making financial decisions. However, what in the past thirteen years has indicated that the CAD will appreciate? Truthfully, nothing.

I have recently received countless messages from Canadians worried about the CAD dropping to a five-year low following Donald Trump’s announcement of a 25% tariff on Canada and Mexico. Although this potential measure has been paused for a month, the damage has been done. This event is just another reflection of the fragility of the Canadian economy and the lack of prospects for sustainable growth.

This decline is not just a temporary market fluctuation but a consequence of more profound structural failures. Canada’s reliance on central bank interventions, government deficit spending, and an inflationary monetary policy has led to a situation where real economic fundamentals are ignored in favour of short-term political gains. A currency's strength should be based on actual savings, productivity, and economic freedom—not artificial stimulus and government interventions that erode long-term stability.

This article will examine the Canadian economy, the potential impact of U.S. tariffs, and what my clients are doing to protect their wealth.

Canada’s economic dependence on the United States is critical to the CAD’s volatility. Any drastic decisions from Washington directly impact the value of the Canadian dollar. The recent tariff episode demonstrates Canada's vulnerability in the global economic landscape, highlighting its fragility in the face of external shocks.

Blaming the CAD’s decline solely on U.S. tariffs is misleading. While the tariffs catalyzed the immediate drop, Canada's underlying structural weaknesses have existed for decades. Canada’s economy is far too reliant on trade policies dictated by foreign governments. This is a fundamental flaw in a system where government intervention replaces genuine free-market trade.

True economic resilience comes from decentralization, sound money, and voluntary exchanges. Government-negotiated trade agreements often distort the price system, leading to misallocated resources and inefficient industries that only survive due to political protection rather than competitive advantage. Canada’s approach to trade has been heavily influenced by bureaucratic decision-making instead of allowing businesses to engage in voluntary, mutually beneficial exchanges.

The Bank of Canada’s policies fail to control inflation, harming consumers and businesses. Sound money, backed by tangible assets, is the path to economic stability

The Bank of Canada has attempted to control inflation, but the measures implemented have proven ineffective. Simply raising interest rates increases national debt while negatively impacting both consumers and businesses. It reduces credit availability, discourages investment, and still fails to curb inflation significantly. As a result, Canadians' purchasing power continues to decline, making the CAD increasingly less attractive to global investors.

Austrian economists like Ludwig von Mises have long warned about the dangers of central bank-driven inflationary policies. Inflation is not just an inconvenience—it is a hidden tax that erodes the value of money, punishing those who save it while benefiting those closest to the money supply, such as banks and large corporations. The artificially low interest rates of the past decade led to an unsustainable boom, encouraging excessive borrowing and “malinvestment.’’ Now that rates are rising, the economy faces the inevitable bust that follows such monetary manipulation.

Rather than relying on central planning through the Bank of Canada, the only real solution is a monetary system based on sound money—one backed by tangible assets instead of fiat currency, which, frankly, is backed by the "honesty of politicians." A free-market monetary system would allow interest rates to fluctuate naturally through supply and demand based on society’s savings rather than government decrees. This would lead to solid long-term economic growth, bringing stability and prosperity in a sustainable way.

Related content: Breaking News: Canada Tax Authorities Pay Homage To Satan With 66.6 Tax

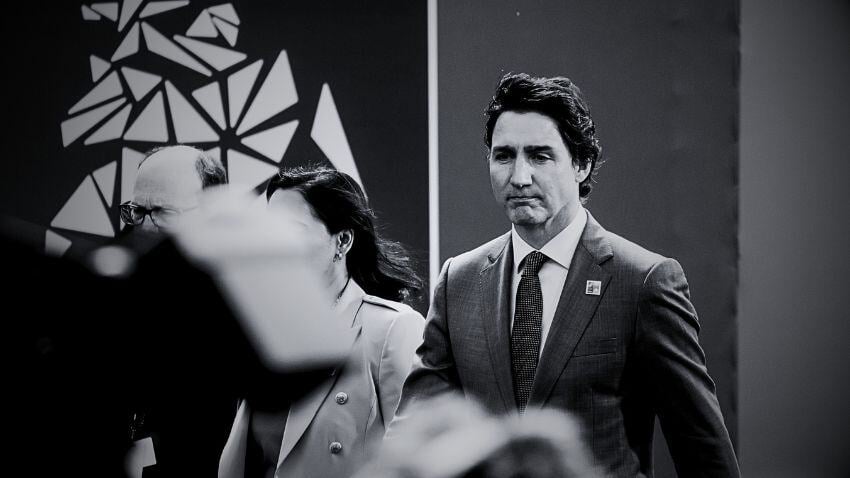

The Canadian government continues to run budget deficits and increase public debt; whether it is Justin Trudeau today or another leader tomorrow, Canada’s economic trajectory has been unsustainable for decades. These policies undermine investor confidence and reduce the currency’s competitiveness in the international market.

Excessive government spending distorts economic incentives and crowds out productive private-sector investments. Every dollar the government spends must come from taxation, borrowing, or inflation—all of which harm economic growth. Taxation reduces incentives for work and investment, borrowing increases the national debt burden, and inflation devalues savings and wages.

Politicians often justify deficit spending by claiming it will “stimulate” the economy. However, this myth has already been debunked, emphasizing that true economic growth comes from real production and savings, not artificial stimulus. When the government spends beyond its means, it effectively redistributes wealth from the productive sector to the politically connected, creating inefficiencies and long-term economic stagnation.

Related content: Why Every Canadian Needs To Buy Foreign Real Estate In 2024

Canada’s economy struggles with commodity dependence and capital flight. Diversification, lower taxes, and economic freedom are vital to reversing this trend and ensuring long-term stability

The Canadian economy heavily relies on commodity exports such as oil and lumber. When the prices of these commodities fall, the CAD suffers a direct impact, making it an unstable currency for long-term investments. Canada remains vulnerable to global market fluctuations without a strong economic diversification strategy.

Entrepreneurship and spontaneous order are essential to creating a diverse and resilient economy. Government interventions—such as subsidies, trade restrictions, and excessive regulations—stifle innovation and limit economic diversification. Instead of allowing businesses to adapt and compete freely, government policies have artificially propped up certain industries at the expense of others, leaving Canada’s economy dangerously unbalanced.

True economic diversification can only come from a bottom-up approach, where entrepreneurs are free to allocate resources based on market signals rather than government mandates. Removing regulatory barriers and lowering taxes would encourage investment in new industries, fostering a more robust and adaptive economy that is not solely reliant on commodity exports.

There is a reason why Canadians make up a significant portion of my audience and are even more prominent among my customer base. Many have already realized that keeping their assets in Canada is a growing risk and are seeking alternatives to protect their wealth. Savvy investors have already taken steps to relocate their capital to more stable economies with more favourable tax policies.

Capital flows to where it is treated best in a truly free-market economy. High taxes, inflation, and excessive regulations drive wealth out of Canada, pushing individuals and businesses to seek better opportunities abroad. Economic freedom is the foundation of prosperity, and countries that respect private property, enforce contracts and minimize government interference naturally attract investment.

The growing number of Canadian expats moving their wealth offshore is not an accident but a rational response to an increasingly hostile economic environment. Those who understand economic principles are taking proactive steps to secure their financial future in jurisdictions that value individual liberty and economic freedom.

With Canada’s economy on an unsustainable path, it’s time to secure your future. Consider alternatives beyond the Canadian dollar and explore global residency and citizenship options

To my Canadian readers: What are you waiting for? The signs could not be more evident—Canada has been on a downward spiral for a long time. Whether due to internal policies or external impacts, the country has positioned itself in an increasingly vulnerable economic situation.

Regardless of Trump’s tariffs today or Trudeau’s policies tomorrow, the reality is that Canada is on an unsustainable path. Do not delay another day if you are serious about protecting your wealth and freedom. The time to blindly trust the Canadian dollar has passed, and it is long past time to consider alternatives outside of Canada and secure a safer future for yourself and your family. Start building your Plan-B by obtaining our free special report on ‘Plan-B Residencies & Instant Citizenships.’

If you want the best intel from the expat world, including profitable offshore opportunities, little-known tax-saving strategies, and hard-won insights on immigration, passports, and Plan-B residencies, all delivered to your inbox every single week, then join our daily correspondence, EMS Pulse®. Currently enjoyed by over 84,000 expats and expat-hopefuls worldwide. Fill in the form below to join our newsletter free:

Written by Mikkel Thorup

Mikkel Thorup is the world’s most sought-after expat consultant. He focuses on helping high-net-worth private clients to legally mitigate tax liabilities, obtain a second residency and citizenship, and assemble a portfolio of foreign investments including international real estate, timber plantations, agricultural land and other hard-money tangible assets. Mikkel is the Founder and CEO at Expat Money®, a private consulting firm started in 2017. He hosts the popular weekly podcast, the Expat Money Show, and wrote the definitive #1-Best Selling book Expat Secrets - How To Pay Zero Taxes, Live Overseas And Make Giant Piles Of Money, and his second book: Expats Guide On Moving To Mexico.

Colombia inspires many thoughts and feelings. Some think of global pop icons like Shakira, J. Balvin, and Karol G. Others are drawn to the magical...

Most people start thinking about moving abroad by asking the wrong kind of question. They ask which country is best for expats, as if there’s some...

Across Latin America, people are replacing socialist governments with leaders who promise security, order, economic recovery, and a return to common...